Blog

Investing

5 Key Benefits of Long Term Investing in Dividend Stocks

Long-term investing in dividend stocks provides the following 5 key benefits:

Long-term investing in dividend stocks provides the following 5 key benefits:

-

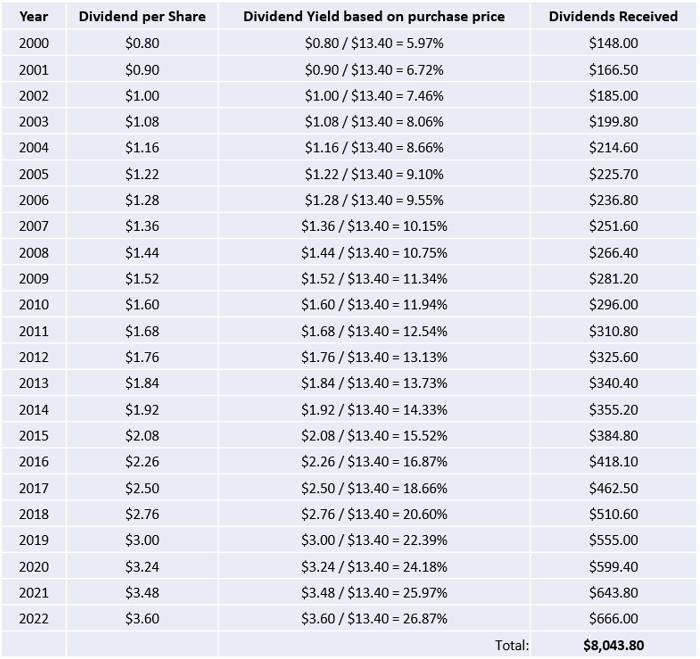

Passive income: One of the primary benefits of dividend investing is the ability to generate passive income. As long as the company continues to pay dividends, an investor receives regular payments that can help supplement their income. Here's my personal example with owning TC Energy:

In 2000, I purchased 185 shares in TRP for $13.40 each, for a total investment of $2479. Since then I have received over $8,0…

In 2000, I purchased 185 shares in TRP for $13.40 each, for a total investment of $2479. Since then I have received over $8,0…

My Strategies For Dealing With a Down Stock Market

How do I handle my stock portfolio during a market downturn? How do I cope with seeing my stocks drop in value? Should I sell? Should I keep investing? These questions came up recently in the Simply Investing Forum. This blog post will answer these questions.

How do I handle my stock portfolio during a market downturn? How do I cope with seeing my stocks drop in value? Should I sell? Should I keep investing? These questions came up recently in the Simply Investing Forum. This blog post will answer these questions.

Focus on quality dividend stocks

In this blog post I will assume you are asking about your dividend stocks that you purchased when they passed the 12 Rules of Simply Investing (in other words quality stocks). I will ignore the following sit…

Do great stocks go on sale during a down market?

Do great stocks go on sale during a down market? The short answer is: yes! Warren Buffett has the patience, and discipline to invest in great stocks when they are priced low. In this article I'll provide you with examples of Buffett's investments, and give you 3 examples of great stocks that are undervalued today.

Do great stocks go on sale during a down market? The short answer is: yes! Warren Buffett has the patience, and discipline to invest in great stocks when they are priced low. In this article I'll provide you with examples of Buffett's investments, and give you 3 examples of great stocks that are undervalued today.

Is the stock market down?

It would seem like the stock market crash has already begun, here are some news headlines from this morning (September 1, 2022):

- S&P/TSX composite down mo…

How to beat inflation with dividend stocks

Does higher inflation have you worried? Are you concerned that your purchasing power will continue to decrease? Dividend stocks can help you beat inflation.

Does higher inflation have you worried? Are you concerned that your purchasing power will continue to decrease? Dividend stocks can help you beat inflation.

How much is inflation?

Bloomberg reported the following on July 13, 2022 regarding US inflation: "The consumer price index rose 9.1% from a year earlier in a broad-based advance, the largest gain since the end of 1981." In Canada on July 20, 2022 CBC news reported: "Inflation rises again, to new 39-year high of 8.1%". As you can see inflatio…

Do you know how to avoid bad stocks?

It's important to know how to identify great stocks, but it's just as important to know how to identify bad stocks so you can avoid them. In this article I'll show you how to identify and avoid lousy stocks.

It's important to know how to identify great stocks, but it's just as important to know how to identify bad stocks so you can avoid them. In this article I'll show you how to identify and avoid lousy stocks.

Will the company be around in 20 years?

Think about the products and services provide by a company before you invest in it. Will those products and services still be in demand 20 years from now? If not, then don't invest your hard earned money in a company that might not be around for the …

Stock market crash got you worried?

Note: The share price and dividends for stock PG listed in this article are correct as of June 7, 2022.

Note: The share price and dividends for stock PG listed in this article are correct as of June 7, 2022.

Are you concerned about a stock market crash? Don't be worried, a market crash presents great investment opportunities if you know where to look.

Are we headed towards a market crash?

The current news doesn't look very promising:

- inflation is at an all time high

- we are seeing record oil prices at gas stations

- supply chain issues are also causing higher prices

- stock market volatility c…

Should you stay away from companies with high debt?

Reading time: 3 minutes

Would you lend money to a friend who had little income and was swimming in debt? Of course not, because the likelihood of you getting your money back would be extremely low. The same is true for investing in companies which have high debt.

What's wrong with high debt?

What's wrong with high debt?

A company with high debt is going to have a hard time paying back its loan if the economy starts to tank. Companies with high debt will have a difficult time surviving downturns. We know from experience t…

Think you need lots of money to start investing?

You don't need thousands of dollars or millions of dollars to get started with investing. Just investing $10 a day could result in eventually earning over $31,000/year in passive income (dividends) and a stock portfolio worth over $1M.

You don't need thousands of dollars or millions of dollars to get started with investing. Just investing $10 a day could result in eventually earning over $31,000/year in passive income (dividends) and a stock portfolio worth over $1M.

Why do I need time and money?

In order to become a successful investor, you need time and money. The more money you have to invest the more dividends you can earn, and the more time you have the more you can reinvest and take advantage of compounding. Having bot…

What is Real Total Return?

In the last 6 months (May to November 2021) the Dow has gone from 34,756 points to 33,290, then up to 35,625 and then dropping to 33,843. What does this all mean? Stock markets are cyclical and it's impossible to accurately predict which way the stock market will go.

In the last 6 months (May to November 2021) the Dow has gone from 34,756 points to 33,290, then up to 35,625 and then dropping to 33,843. What does this all mean? Stock markets are cyclical and it's impossible to accurately predict which way the stock market will go.

Markets are cyclical

This fluctuation is normal, many believe that the market is still high, and further declines are coming. I’m not going to make any predictions, in fact no one can accurately predict where stock prices will go.…

Why do people invest in lousy companies?

Why do people invest in companies that are not financially healthy? I recently received this question from a reader, and today I'll answer that question.

Why do people invest in companies that are not financially healthy? I recently received this question from a reader, and today I'll answer that question.

A financially healthy company is one that is consistently profitable, has low debt, consistently increases shareholder value, sells a great product or service, and a number of other factors. To keep things simple, I created the 12 Rules of Simply Investing to help you determine if a company is a quali…