FAQ

Frequently asked questions

Save time, earn more, and reduce your risk by learning how to invest in the best dividend stocks

Part 1: General investing questions

1-1. What is dividend value investing?

1-2. Is this investing approach difficult to learn and implement?

1-3. Can't I just learn this investing approach on my own?

1-4. Am I getting the best value for the money I spend on your course?

1-5. Are you teaching day trading?

1-6. Does value investing really work? Is this something new?

1-7. Are you qualified to teach this?

1-8. Can you invest my money for me?

1-9. Do you teach in-depth analysis of financial statements?

1-10. Do you teach day trading and options trading?

1-11. What is the difference between the SI Course, SI Platform, and the SI Platform-Lite?

1-12. I'm not sure, should I buy the SI Course or subscribe to the SI Platform?

1-13. What is the difference between the SI Google Sheet and the SI Platform?

1-14. How do I get started, and what accounts or software do I need?

1-15. When it comes to investing how do I reduce my risk?

1-16. What is a dividend?

1-17. How do I make money with dividend stocks?

1-18. Is the dividend safe?

1-19. How much money can I make?

1-20. How do I earn passive income?

1-21. What is your opinion on automatically reinvesting dividends (using DRIPS)?

1-22. I really can’t manage my own investments; I’d prefer to leave it to the professionals.

1-23. What's wrong with investing in Mutual Funds, Index Funds, or ETF?

1-24. How much money should I be investing?

1-25. I heard dividends aren't that important. Isn't selling an equal amount of stock equivalent to getting a cash dividend?

1-26. What do I need to start investing?

1-27. Can you provide a list of Trading Platforms?

1-1. What is dividend value investing?

The value investing approach is to buy stocks when they are priced low (undervalued). The dividend investing approach is to buy stocks that pay dividends. Dividends are an amount of money a company gives you for owning their shares (I explain more about what dividends are in 1-16). I have combined the best of both worlds. My teachings show you how to invest in quality stocks that are priced low and pay dividends.

A stock is a quality stock if it passes the 12 Rules of Simply Investing. Quality undervalued stocks allow you to safely, quickly, and reliably build for yourself a passive stream of growing income from dividends.

1-2. Is this investing approach difficult to learn and implement?

Dividend value investing is not difficult to learn at all. In fact the course makes it easy for everyone to understand. You do not need a degree in finance, economics or accounting in order to apply the principles. I explain value investing in plain english, making it easy for you to understand and implement in a few simple steps. It is so simple a 9 year old could do it -- both my kids started investing at the age of 9.

1-3. Can't I just learn this investing approach on my own?

Sure you can. There are lots of resources and books available on the topic of value investing and dividend investing. However, you will have to spend a considerable amount of time reading, talking to other investors, and applying the principles of value investing through trial and error. It would cost more and take longer to learn how to invest on your own rather than taking my course. Why not learn quicker from my mistakes and experience?

1-4. Am I getting the best value for the money I spend on your course?

Absolutely. You will learn how to increase your wealth, reduce your fees, reduce your risk and manage your own money.

The average investor pays $1,100 annually for every $50,000 invested in mutual funds (assuming an MER of 2.2%). Most non-commission fee based financial planning firms charge between $1000-$5000 to develop an investment strategy for you, and then charge you an average $150 per hour for consultation. A typical value investing course at a university will cost over $1000, not to mention the number of hours required to attend the course.

Past students have realized after implementing my dividend value investing strategy that within 12 months they have already recouped their $297 investment in the course in the form of dividends received (based on a $7500 portfolio and 3.96% dividend yield).

Our course pays for itself in less than 12 months, and allows you to build a stream of growing passive income.

1-5. Are you teaching day trading?

No, this is not a day trading course. Day trading is very risky and we do not recommend it. This is not a get-rich-quick scheme. Value investing is a strategy that works over time. The average holding period for value stocks is 5 years or more.

1-6. Does value investing really work? Is this something new?

Value investing is not new. In fact Benjamin Graham first wrote about it in 1934. Investors all over the world have applied the concept and reaped huge rewards.

Derek Foster was able to retire at the age of 34. John Greaney retired at the age of 38. Warren Buffet – the most famous of value investors – has been on the Forbes list of the richest people in the world for decades.

Having practiced dividend value investing for more than 20 years, my own investments continue to have great returns. Click here to view my results. The list of successful value investors is long; we cover a few in the course and learn how they achieved financial success.

1-7. Are you qualified to teach this?

Yes. I have spent over 20 years learning about and practicing dividend value investing. Through research and interviewing other value investors I have been able to perfect my own investment strategy. However, I am not a professional financial planner, accountant, or economist. Nor do I work for the mutual fund, banking, or insurance industries. This is why I am able to provide completely unbiased information.

My own experience, enthusiasm for investing, passion for teaching, record of performance, and experience teaching value investing over the years qualify me to pass on valuable investment knowledge and expertise. You can also read what former students have had to say after taking my course.

1-8. Can you invest my money for me?

No. Simply Investing (SI) does not invest your money on your behalf. The goal of SI is to help you invest by yourself for yourself.

1-9. Do you teach in-depth analysis of financial statements?

Depends what you mean by in-depth analysis. There are different levels of analysis. You could spend a few minutes to a few hours reviewing financial statements. The goal at Simply Investing is to help you learn how to quickly identify quality stocks that are undervalued.

In the SI Course I show you how to easily view a Balance Sheet and Income Statement, then determine quality and value based on the data. Or you could skip this step and move to Module 4 (in the course) and learn how to use the SI Report.

From the Balance Sheet and Income Statement we extract the following data points:

- EPS Growth over the last 10 years

- Dividend per share growth over the last 10 years

- Payout Ratio

- LT Debt/Equity Ratio

- Share buyback

- P/E Ratio

- Current Div Yield

- 10 year Average dividend yield

- P/B Ratio

- Book Value Per Share

- The annual dividend

The above data is entered into the SI Excel spreadsheet, then the values are applied to the 12 Rules of Simply Investing.

No.

The focus of the Simply Investing Course and Simply Investing Report is to help you become a successful dividend value investor. My goal is to teach you how to build a passive stream of growing income by investing in quality dividend paying stocks when they are undervalued.

1-11. What is the difference between the SI Course, SI Platform, and the SI Platform-Lite?

The Simply Investing Course:

- Consists of 27 video lessons, bonus videos, a guide book (PDF), portfolio tracker, and Google spreadsheet

- The Google Spreadsheet automatically applies the 10 SI Criteria rules to each stock, after you've filled in the financial data

- Teaches you "The 12 Rules of Simply Investing" and how to find quality dividend paying stocks that are undervalued (priced low)

- Can be purchased for a one-time payment, and comes with unlimited access to the course, the SI Platform-Lite, and any future updates

- Value and Premium packages also come with membership to the Simply Investing Forum

The Simply Investing Platform:

- The SI Platform is a web application that tracks over 6000 common stocks in the US and Canada

- The SI Platform lists stocks that are undervalued (priced low) and the ones that are overvalued (priced high)

- Applies the SI Criteria to each stock every day, and applies a grade out of 10 to each stock

- Access to all features including the 3 basic features in the SI Platform-Lite

- Click here to see the complete list of features, and to watch the overview video

- Provides you with over 120 metrics for each stock

- Can be purchased by a monthly or annual subscription

The Simply Investing Platform-Lite:

- As part of your course purchase, you have access to the following 3 features:

- Basic Search, which gives you access to financial data on over 6000 common stocks in the US and Canada (including up to 21 years of historical data)

- Access to the DOW 30 list of companies

- Access to the TSX 60 list of companies

- Access to the SI Platform-Lite cannot be purchased separately, it only comes with the SI Course purchase (Basic, Value or Premium)

1-12. I'm not sure, should I buy the SI Course or subscribe to the SI Platform?

The Simply Investing Course is right for you if:

- you are new to dividend investing

- you have the time and interest to want to learn the best way to invest for yourself

- you are a true do-it-yourself investor and want to learn how to identify quality stocks for purchase (our course takes about 3.5 hours to complete)

- you want to learn and apply the SI Approach to any stock in any market

- you enjoy gathering financial data, and using the SI Spreadsheet to determine the best stocks to buy

- you prefer the DIY approach to investing

The Simply Investing Platform is right for you if:

- you understand the 12 Rules of Simply Investing and how to apply them to select quality stocks

- you do not have the time or desire to perform any stock research yourself

- you want to know immediately what to buy, and what to avoid

- you prefer the DIY approach with help

1-13. What is the difference between the SI Google Sheet and the SI Platform?

The Simply Investing Course comes with a Google Spreadsheet that you can use to analyze stocks. The Google Spreadsheet automatically applies the 10 SI Criteria rules to each stock, after you've filled in the financial data. You can also use the Google Sheet to also analyze international stocks.

The Simply Investing Platform:

- The SI Platform is a web application that tracks over 6000 common stocks in the US and Canada

- The SI Platform lists stocks that are undervalued (priced low) and the ones that are overvalued (priced high)

- Applies the SI Criteria to each stock every day, and applies a grade out of 10 to each stock

- Click here to see the complete list of features, and to watch the overview video

- Can be purchased by a monthly or annual subscription

1-14. How do I get started, and what accounts or software do I need?

1-15. When it comes to investing how do I reduce my risk?

When it comes to investing, your investments may face these 7 types of risks:

Risk #1: The dividend is not guaranteed, it may be reduced or terminated

Risk #2: The company may face stiff competition

Risk #3: Dishonest management and directors

Risk #4: The company may go bankrupt

Risk #5: Political unrest or governmental policy changes may hurt corporate profits

Risk #6: A recession or depression may reduce stock prices

Risk #7: Natural disasters

I cover all 7 types of risks, and their solutions in 9 minutes in Lesson 24 of the SI Course.

A dividend is a payment made by a corporation to its shareholders, usually as a distribution of profits. When a corporation earns a profit or surplus, the corporation is able to re-invest the profit in the business and pay a portion of the profit as a dividend to shareholders.

For example if Company ABC is paying a dividend of $1 per share, and you own 1000 shares, you will receive $1000 every year, for as long as you continue to own those shares and as long as the company continues to pay the $1/share dividend.

Dividends are your to keep, you can choose to spend the money or re-invest it.

1-17. How do I make money with dividend stocks?

There are three ways to make money with dividend stocks:

- Through stock price appreciation (if stock price goes up, you can earn a profit; also called capital gains)

- By collecting dividends

- By holding on to your dividend stocks to take advantage of increasing dividend payments. Over time you may receive more in dividends than your original investment.

Dividends are not guaranteed. Companies are under no legal obligation to pay you a dividend. They can reduce or eliminate the dividend at any time.

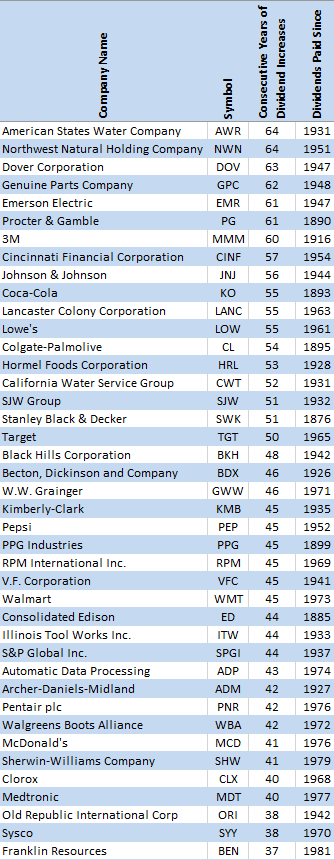

However, your goal is to focus on companies that have a history of paying dividends for a long time and/or increasing their dividends each year. Here is just a small sample of companies you should be interested in:

No one can predict which companies will cut their dividends, but you can look at the table above and have a high degree of confidence that companies like these will continue to pay dividends that will continue to increase.

Even across dividend paying companies, it is important to diversify so that if a company cuts their dividend, your portfolio continues to deliver increasing dividends. In more than 20 years of dividend investing, my portfolio has increased its dividend income every single year.

1-19. How much money can I make?

In order to make money you need: time and money

Time to take advantage of dividend increases. The younger you start investing the better off you will be. It takes many years for dividend increases to finally start yielding double-digit returns. With enough time on your side you will be able to weather any economic downturns.

You need money to make money. Here's a look at the returns based on how much you invest, for a single stock yielding 5%:

- $1000 invested after one year will yield $50 in dividends

- $10000 invested after one year will yield $500 in dividends

The more money you invest the more money you can make.

Having both time and money will help you achieve financial success sooner.

To answer your question then, how much money can I make? This will depend on how much money you are able to invest, and how long you are able to stay invested.

You can use our Google Sheet to estimate how much money you can make. You can then update the values in the green cells to try out different scenarios.

1-20. How do I earn passive income?

Passive income is money you make with no additional effort. Earning dividends is passive income. You make money while you sleep. Once you own dividend stocks, there is not any more work for you to do -- just continue to own your stocks. Your dividends are automatically deposited into your trading account as cash. You can choose to spend your dividends, or re-invest them into more dividend stocks. Your passive income will automatically grow as the dividends are increased by the companies over time.

1-21. What is your opinion on automatically reinvesting dividends (using DRIPS)?

Once a Dividend Reinvestment Plan (DRIP) is started the company will automatically reinvest your dividends back into their shares instead of paying you the cash dividend. DRIPs allow you to accumulate more shares over time without investing any new money.

I do not use DRIPs, and I do not advocate using DRIPs. The biggest problem with them is that you end up buying stocks when they are overvalued. Stock prices go up and down all the time. For example, if I bought shares in McDonald’s for $150 because it was undervalued, do I really want to be buying more shares when they are overvalued at $250? I would prefer that the company gave me the dividends in cash. Then once or twice a year I can take that money (plus dividends from other companies) and invest it into another stock that is undervalued. There is no harm in sitting on cash for a while.

DRIPs are good for people who:

- Do not want to review their portfolio at least twice a year

- Want an automatic investing system that they can forget about

- Want an automatic system of forced savings

The Simply Investing Report shows you exactly when a stock is undervalued (priced low) and overvalued (priced high). I believe any benefits of dollar cost averaging are lost when you buy stocks that are overvalued. It is always better to buy quality stocks when they are undervalued.

1-22. I really can’t manage my own investments; I’d prefer to leave it to the professionals.

In that case you have to be prepared to pay fees for as long as you stay invested. Professional advisors charges thousands in fees each year for managing your money. No-cost advisors are paid commissions from the mutual fund companies, those commissions come from the fees (sometimes hidden fees) that you pay on your funds. Any funds that have any fees associated to them will result in lower returns for you.

- you have $300,000 invested (could be in your 401(k)/IRA/RRSP/TFSA)

- you regularly save and invest another $100 every month

- $3,026,856.74 if the MER is 2.5%

- $1,210,742.69 if the MER is 1.0%

- $605,371.35 if the MER is 0.5%

- $96,859.42 if the MER is 0.08%

Wouldn't you like to save the $96K or $3M for yourself?

Yes, a $300,000 stock portfolio over 45 years would cost you:

- $199.80 if you invested in 20 stocks

- $299.70 if you invested in 30 stocks

- $399.60 if you invested in 40 stocks

- $499.50 if you invested in 50 stocks

1-23. What's wrong with investing in Mutual Funds, Index Funds, or ETF?

There's 4 things about mutual/index/ETF funds that will hurt your returns in the long-term:

- Funds unintentionally buy stocks when they are overvalued, as a do-it-yourself (DIY) investor you should only buy stocks when they are undervalued (priced low)

- Funds buy lousy stocks (non-quality stocks), as a DIY investor you should only buy quality stocks that pass the 12 Rules of Simply Investing

- With funds your are still paying fees, even a low fee of 0.05% comes out to $1250 annually for every $250K you have invested, in 10 years you'll pay over $12,500 in fees

- Funds constantly buy-and-sell stocks, this incurs fees for every transaction. There is tremendous value in holding stocks for the long-term

Index Fund vs Individual Stocks

Index Fund

- Amount invested: $100,000

- Index Fund Fee: 0.08%

- Index Fund: Vanguard Value Index (VVIAX)

- Total fees paid after 25 years: $2,000.80

Individual Stocks

- Amount invested: $100,000

- Trading Fee: $9.99 per trade

- Number of stocks held: 20

- Total fees paid after 25 years: $199.80

The Vanguard index fund certainly has lower fees, but keep in mind that's $2,000 for every $100K you have invested. For a $500K portfolio the fees go up to $10,004. Plus you end up paying those fees each year for as long as you continue to hold those funds. With individual stocks you pay $9.99 per trade when you buy and then another $9.99 per trade when you decide to sell. I think you'll agree that $199.80 is much less than paying $2,000.

Index investors will argue that they get better diversification than owning individual stocks, but the truth is they are over diversified. I've written about diversification and risk here.

Index investors will then argue that it takes too much time to research individual stocks, but the truth is using my Simply Investing Report is faster than researching the 1000’s of index funds out there.

Still think it's better for you to buy Index Funds (or ETFs), instead of investing on your own? Find your answer here and here.

1-24. How much money should I be investing?

How much you should be investing depends on how much money you would like to earn or need in the future.

- When would you like to retire?

- How many days a week would you like to work?

- What sort of luxuries would you like to be able to afford and how often would you like to be able to buy them?

- How much do you want to donate to charities, pursue your hobbies, or learn something new?

- How much money would you like to leave to look after your family when you pass away?

1-25. I heard dividends aren't that important. Isn't selling an equal amount of stock equivalent to getting a cash dividend?

There are 4 main benefits of investing in dividend stocks:

- Dividends provide an immediate return on your investment, regardless of stock price

- Dividends provide cash in your pocket, you can spend the money if you wish or re-invest it

- Once given out dividends cannot be taken back, if your company declines (or goes bankrupt) the dividends you've received over the years are yours to keep

- Over time dividends reduce your risk, by increasing your margin of safety

Here's a quick example to illustrate the benefits of dividends using my personal experience:

- In 2000 I purchased 185 shares of TRP for $13.40 which represented an investment of $2479 ($13.40 x 185 shares)

- In 2000 the dividend for TRP was $0.80/share, today the dividend is $3.24/share

- Since I've owned those shares I've earned over $6179 in dividends

- Those 185 shares now generate over $599 annually in dividends, which continues to grow each year due to dividend increases

Without dividends I would have had no choice but to sell my shares in order to generate $6179, but then I would have less shares. In order to continue receiving $599 annually (just like the dividends) I would have to continue to sell my shares each year, eventually running out of shares to sell.

1-26. What do I need to start investing?

Investing requires 5 things:

- Knowledge: investing knowledge so you know what to invest in, and how to invest in it. This is knowledge I can teach you in my course.

- Time: investing in the stock market is a long-term strategy. The sooner you start investing, the better off you will be.

- Money: it takes money to make money. The more you have to invest, the more you will make (example: 5% return on $1000 is higher than 5% return on $100).

- Patience: you need to have the patience to ride out any market downturns.

- Discipline: you need to have the discipline to stick to your plan for the long-term. You cannot jump from one strategy (day trading, growth investing, swing trading … etc) to the next.

Part 2: Questions about the Simply Investing Course

2-1. What exactly is the Simply Investing course?

2-2. What is included in the Simply Investing Course?

2-3. Can I really learn how to invest successfully with just one course?

2-4. What makes this course so different, than other investing seminars and books?

2-5. Do I need to be mathematical genius, or financial wizard to take this course?

2-6. I’m worried about wasting my money on yet another course?

2-7. Is this course just for making money for retirement?

2-8. When is the best time to start investing?

2-9. How long does it take to complete the course?

2-10. How much time and effort do I have to spend after taking the course?

2-11. Is this course applicable to international dividend paying stocks, or does it only apply to US and Canadian stocks?

2-12. I'm not investing in US or Canadian stocks, which course package is best for me?

2-13. Can this course help me evaluate UK stocks?

2-14. I already work with a broker or financial advisor. Do I still need this course?

2-15. What is the difference between the SI Course, SI Platform, and the SI Platform-Lite?

2-16. Can I buy the Basic package then upgrade later?

2-17. What is the benefit of the Simply Investing Forum?

2-18. How much does the course cost?

2-19. Can I try the SI Course for free?

2-1. What exactly is the Simply Investing Course?

The Simply Investing Course is an online video course created by me (Kanwal Sarai) to teach you the best way to invest. I teach the principles of value investing with a focus on dividends. These are the same concepts used by successful investors like Warren Buffet, Benjamin Graham and Geraldine Weiss. Learn more about my course, and view the course outline here.

2-2. What is included in the Simply Investing Course?

The Basic Package includes:

- Simply Investing Course

includes 10 Modules (27 Lessons) - Simply Investing Reference Guide

includes How-to Section and Q&A - Simply Investing Spreadsheet

Google Sheet automatically applies the 10 SI Criteria Rules, after you've entered in the financial data - Includes the free SI Stock Portfolio Tracker

use it to track your investments and dividends - Bonus Modules

includes 4 video modules - Lifetime Access to SI Platform-Lite

access to 3 basic features, and 21 years of stock data - SI Platform-Full

includes 1 month free access - Lifetime Access to Course

includes any future updates - Money Back Guarantee

30 day money back guarantee

The Value Package includes:

- Everything in the Basic Package

includes everything from the Basic Package - SI Platform-Full

includes 2 months free access - Lifetime Access to Forum

a place for Q&A - 10% discount on future purchases

receive a coupon code

Pricing information is listed here.

2-3. Can I really learn how to invest successfully with just one course?

Yes, I teach you everything you need to know to invest successfully. The 10 modules in the online course cover all aspects of investing on your own. Included in the course are hands-on exercises, the Simply Investing Spreadsheet, a portfolio tracker, and Reference Guide. The Simply Investing Course has been bought in over 25 countries. Students are able to start investing immediately after completing the course.

2-4. What makes this course so different, than other investing seminars and books?

Books can cover the material but do not provide hands-on exercises like I do in the online course. I use examples, slides, animation, visual cues, and audio to make the content easy to understand.

Most investing seminars are really sales presentations to get you to buy additional products and services. The SI Course is not a sales presentation. The course is all you will need to get started in investing.

After you leave a seminar you have no way of reviewing the material again. My course is always available to you online. It is accessible anywhere in the world 24 hours a day, 7 days a week. You are able to repeat any of the lessons as often as you wish. Any updates to the video or Simply Investing Worksheet are always available.

2-5. Do I need to be mathematical genius, or financial wizard to take this course?

No. You do not need a background in finance, accounting, or economics to complete my course. I have designed the course for the busy, working professional. It is simple enough to understand yet powerful enough to give you positive results quickly. My students range from ages 9 (both my kids completed the course at 9 and each have their own stock portfolio) to 70 and are from all walks of life. I teach the course in plain English, without the financial jargon and terms that only confuse people.

2-6. I’m worried about wasting my money on yet another course?

I understand your concern which is why I offer a no hassle 30-day money back guarantee. If you do not find the course useful, send me an email and I will happily refund your money. I want you to succeed.

2-7. Is this course just for making money for retirement?

Not at all. My course is designed to help you start earning more right away. Some people use that money immediately, some people use it to reduce their day job to part-time, some people use it to retire early and some people may wait until they reach age 65. The income you earn is yours to keep and spend according to your desires.

2-8. When is the best time to start investing?

Regardless of market conditions, it is always a good time to buy quality stocks when they are undervalued (priced low). The key is to know when a stock is undervalued and when it is a quality stock, in order to figure that out I use my 12 Rules of Simply Investing.

The best time to start investing is now. The longer you wait to start investing the more money you stand to lose. Consider the story of Jack and Jill, where Jack lost $97,429 by waiting too long to start investing.

2-9. How long does it take to complete the course?

The course is divided into ten modules, and takes about 3.5 hours to complete. But you can take your time and repeat any of the modules as often as you like. I provide you with lifetime access to the online course. Also included is the Simply Investing Reference Guide, Spreadsheet (in Excel), stock portfolio tracker, and bonus videos.

2-10. How much time and effort do I have to spend after taking the course?

Not much. After completing the course you will be able to start right away. Applying the concepts of dividend value investing takes as little as 15-45 minutes when you are ready to invest. This means if you only buy stocks twice a year, then you only have to spend time twice a year on applying the 12 Rules of Simply Investing in order to determine the best stocks for purchase. I understand everyone is busy in their lives, and you do not want to spend hours and hours reviewing company data. My course teaches you how to focus on the important stuff and get on with the rest of your life.

2-11. Is this course applicable to international dividend paying stocks, or does it only apply to US and Canadian stocks?

In the course I use examples of Canadian and U.S. stocks, but you can certainly apply the same concepts to stocks anywhere in the world. I have customers from Azerbaijan, Sweden, U.S., Thailand, Tanzania, Switzerland, South Africa, Singapore, New Zealand, Romania, Qatar, Norway, Malaysia, India, Hungary, UK, France, Czech Republic, Brunei, Uruguay, Australia, and Canada who have completed the course and successfully applied the dividend value investing principles.

2-12. I'm not investing in US or Canadian stocks, which course package is best for me?

I recommend starting with the Basic Package.

The benefit of the Value Package is access to the forum, but on that forum we only publish a list of undervalued US and Canadian stocks (that you can add to your Excel spreadsheet for research). Since we do not publish a list of international stocks, the Value Package will not be of much help to international investors.

However you can apply the concepts learned in the Basic Package to stocks anywhere in the world.

2-13. Can this course help me evaluate UK stocks?

Yes. This course includes the following 3 additional resources to help you apply the 12 Rules of Simply Investing to UK stocks:

- The Simply Investing Spreadsheet designed specifically for evaluating UK stocks

- Bonus Video 3 shows you how to obtain a list of UK stocks to begin populating your spreadsheet

- Bonus Video 4 which takes you step-by-step through the process of collecting financial data for UK stocks

2-14. I already work with a broker or financial advisor. Do I still need this course?

Yes. This course will help you to ask better questions when it comes to meeting with your broker or financial advisor. You will be equipped with the knowledge to ask about their investing strategy and financial performance, and understand the financial jargon. In addition this course will bring clarity and understanding when it comes to reviewing your statements.

Keep in mind that brokers have hundreds of clients. How much time and effort do you think your broker is giving to your investments? Usually it is the wealthier clients that get the broker’s attention. You owe it to yourself to become knowledgeable about your own investments instead of leaving it up to someone else.

2-15. What is the difference between the SI Course, SI Platform, and the SI Platform-Lite?

The Simply Investing Course:

- Consists of 27 video lessons, bonus videos, a guide book (PDF), portfolio tracker, and Google spreadsheet

- The Google Spreadsheet automatically applies the 10 SI Criteria rules to each stock, after you've filled in the financial data

- Teaches you "The 12 Rules of Simply Investing" and how to find quality dividend paying stocks that are undervalued (priced low)

- Can be purchased for a one-time payment, and comes with unlimited access to the course, the SI Platform-Lite, and any future updates

- Value and Premium packages also come with membership to the Simply Investing Forum

The Simply Investing Platform:

- The SI Platform is a web application that tracks over 6000 common stocks in the US and Canada

- The SI Platform lists stocks that are undervalued (priced low) and the ones that are overvalued (priced high)

- Applies the SI Criteria to each stock every day, and applies a grade out of 10 to each stock

- Access to all features including the 3 basic features in the SI Platform-Lite

- Click here to see the complete list of features, and to watch the overview video

- Provides you with over 120 metrics for each stock

- Can be purchased by a monthly or annual subscription

The Simply Investing Platform-Lite:

- As part of your course purchase, you have access to the following 3 features:

- Basic Search, which gives you access to financial data on over 6000 common stocks in the US and Canada (including up to 21 years of historical data)

- Access to the DOW 30 list of companies

- Access to the TSX 60 list of companies

- Access to the SI Platform-Lite cannot be purchased separately, it only comes with the SI Course purchase (Basic, Value or Premium)

2-16. Can I buy the Basic package then upgrade later?

Yes, you can upgrade anytime after you login to your account.

If you purchased the Basic/Value Package before December 12, 2019, you will have to contact me to upgrade your package.

2-17. What is the benefit of the Simply Investing Forum?

The private Simply Investing Forum (only open to customers who purchase the Value or Premium Package) allows you to ask questions and view questions and answers from other students.

2-18. How much does the Course cost?

The Simply Investing Course is available in 2 packages, pricing is listed here.

2-19. Can I try the SI Course for free?

There is no free edition. But if you are unsatisfied with the course, I do offer a 100% money back guarantee for 30 days. Just send me an email within 30 days and I will happily return your money.

Part 3: Questions about the Simply Investing Platform

3-1. When is the data updated in the Simply Investing Platform?

3-2. How many stocks are tracked in the SI Platform?

3-3. As a subscriber how do I access the SI Platform?

3-4. What data is available for the stocks tracked in the SI Platform?

3-5. Do you track international stocks?

3-6. Can I buy just a single month subscription?

3-7. Can I try the SI Platform for free?

3-1. When is the data updated in the Simply Investing Platform?

The financial data (including stocks prices) is updated once a day, end of day.

3-2. How many stocks are tracked in the SI Platform?

Over 6000 common stocks that trade on the NASDAQ, NYSE and TSX exchanges.

3-3. As a subscriber how do I access the SI Platform?

When you subscribe to the SI Platform you will create your own PIN. You will then use your email address and PIN to login to the SI Platform.

3-4. What data is available for the stocks tracked in the SI Platform?

The SI Platform provides you with the following 8 pre-built tables:

- Top Ranked Stocks (stocks that get 10/10 in the SI Criteria)

- Runners-Up Stocks (stocks that get 9/10 in the SI Criteria)

- Undervalued Dividend Stocks

- Overvalued Dividend Stocks

- Deep Valued Dividend Stocks

- Undervalued non-Dividend Stocks

- Overvalued non-Dividend Stocks

- Deep Valued non-Dividend Stocks

The SI Platform also provides you with over 120 metrics for each stock.

3-5. Do you track international stocks?

No, at this time we only track US and Canadian stocks.

3-6. Can I buy just a single month subscription?

You can subscribe on a monthly basis and then you are able to cancel at any time.

3-7. Can I try the SI Platform for free?

Yes, there is a free 14-day trial available. The free account is limited to a universe of 15 stocks, however this allows you to test drive the platform free of charge, a credit card is not required.

Part 4: Customer Service questions

4-1. How do I update my billing information?

4-2. How do I obtain a copy of my receipt?

4-3. How do I change my password?

4-4. I forgot my password, what do I do?

4-5. I forgot my user ID, what do I do?

4-6. How do I change my user ID?

4-7. How do I change my email address?

4-8. What is your refund policy?

4-9. How do I request a refund?

4-10. I bought the Basic Package, how do I access the Simply Investing Course?

4-11. I bought the Value/Premium Package, how do I access the Simply Investing Course?

4-12. How do I access the Simply Investing Platform?

4-13. How do I access the Simply Investing Forum?

4-14. Why can I not access the Simply Investing Forum?

4-15. Why can I not access the Simply Investing Platform?

4-16. I purchased the Premium Package, how do I book my 1-hour call with Kanwal?

4-17. How do I cancel my subscription to the Simply Investing Platform?

4-18. What is the best way to contact Simply Investing (email, phone, twitter, or Facebook)?

4-19. I bought the Course (or Report) why did I not receive any email on how to access my purchase?

4-20. I accidentally bought the Course/Report in the wrong currency, how can I fix this?

4-21. I purchased the Basic Course Package, how can I upgrade to the Value Package?

4-22. I purchased the Basic/Value Course Package, how can I upgrade to the Premium Package?

4-23. When I am logged into my SI account, I cannot see the Blog. How do I access the Blog?

4-24. Where do I login to access the SI Course or SI Platform, I lost my welcome email?

4-25. I have more questions that aren’t on this list. Where can I go to get answers?

4-1. How do I update my billing information?

For purchases made after December 12, 2019 follow these instructions:

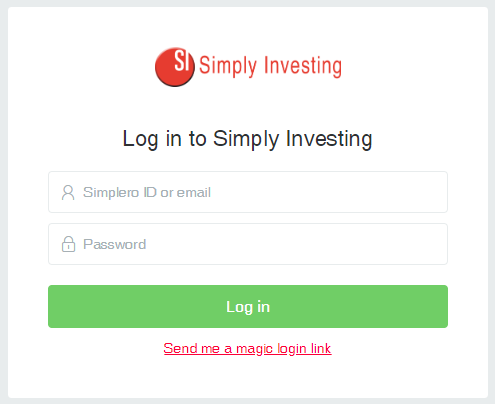

- Login to your account here

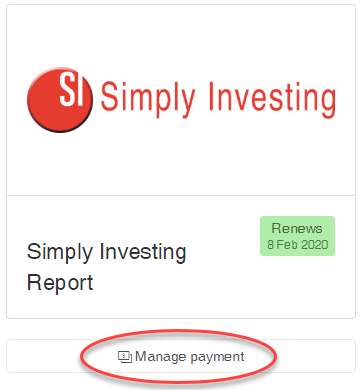

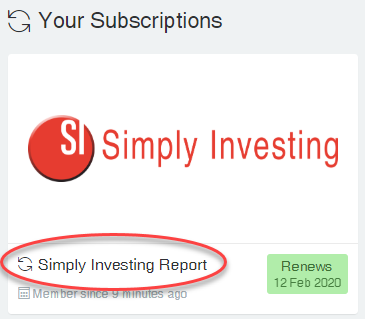

- Under "Your Subscriptions", click on Simply Investing Report

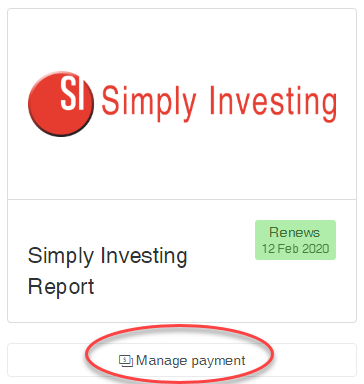

3. On the right-hand side, click on the "Manage Payment" button

4. Select the option for "New Payment Method"

5. Enter your new billing information and click on the Continue button

For purchases made before December 12, 2019 please email us: info@simplyinvesting.com

4-2. How do I obtain a copy of my receipt?

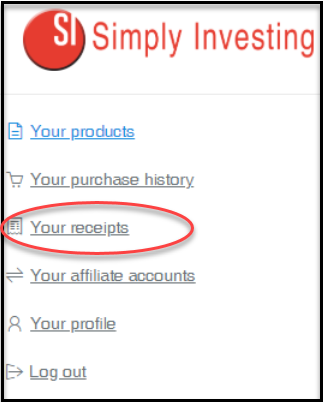

For purchases made after December 12, 2019 follow these instructions:

- Login to your account here

- On the left-hand side of the page, click on "Your Receipts"

For purchases made before December 12, 2019 follow these instructions:

Please email us: info@simplyinvesting.com

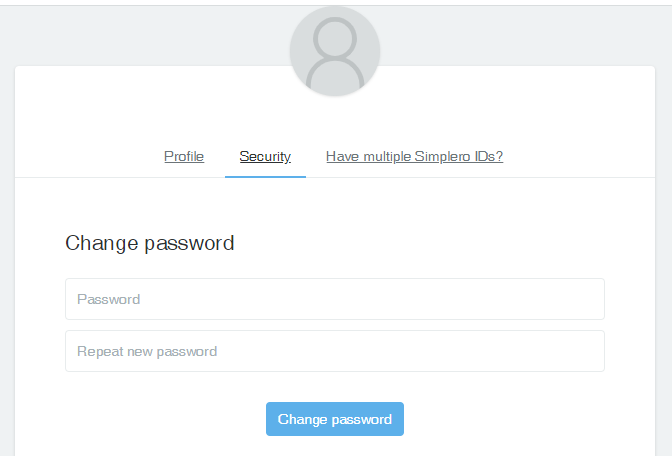

4-3. How do I change my password?

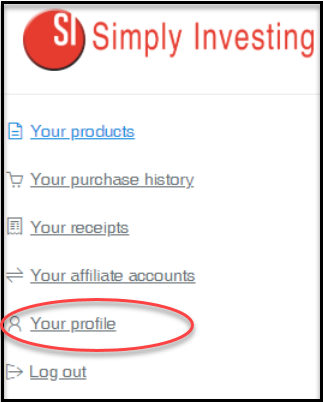

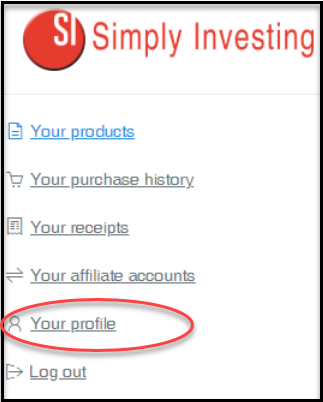

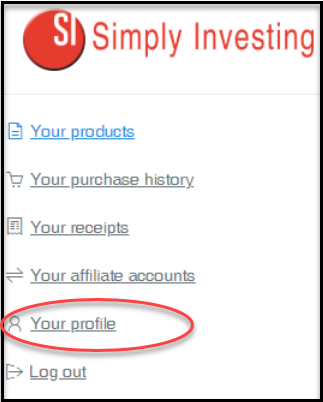

- Login to your account here

- On the left-hand side of the page, click on "Your Profile"

3. On the center of the page, click on "Security"

4. Enter your new password, click on the "Change Password" button

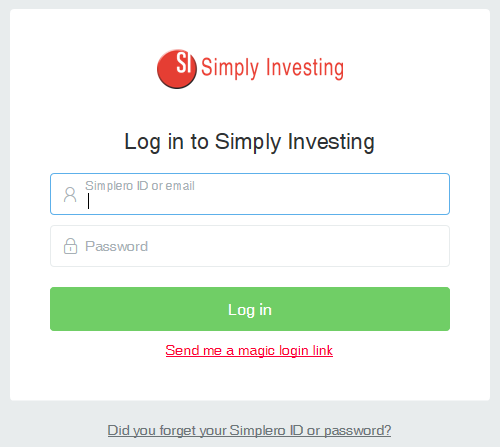

4-4. I forgot my password, what do I do?

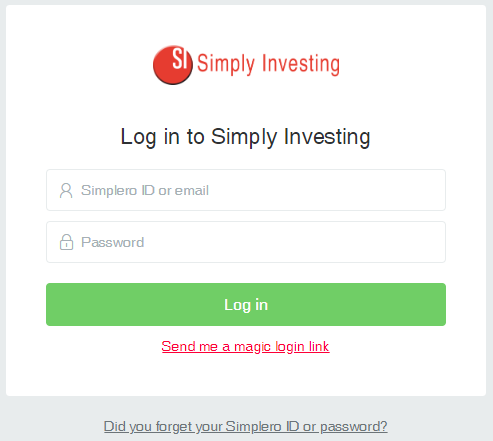

- Go to the login page here

- Click on "Did your forget your Simplero ID or password?

3. We will send you an email to reset your password

4-5. I forgot my user ID, what do I do?

- Go to the login page here

- Click on "Did your forget your Simplero ID or password?

3. We will send you an email with all the details

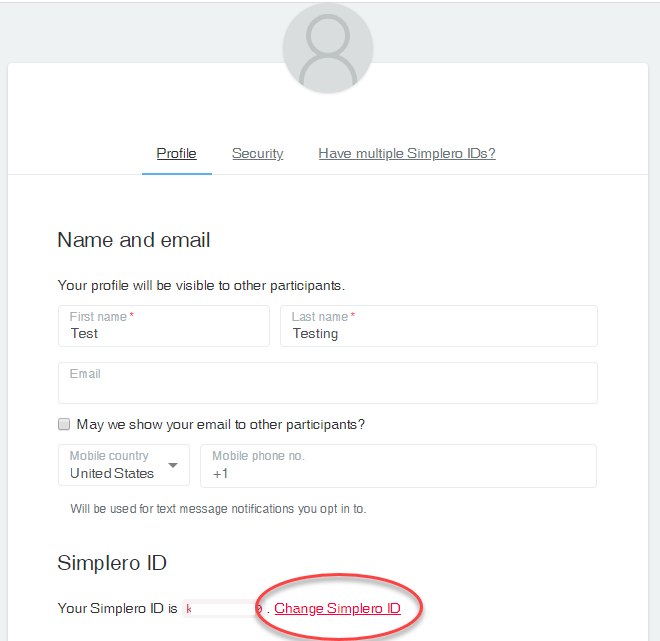

4-6. How do I change my user ID?

- Login to your account here

- On the left-hand side of the page, click on "Your Profile"

3. Click on "Change Simplero ID"

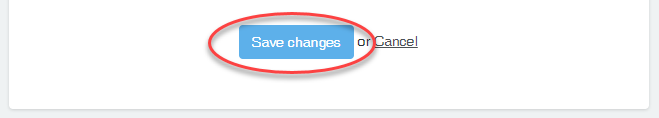

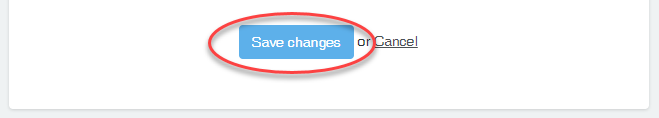

4. Scroll to the bottom of the page and click on "Save Changes" button

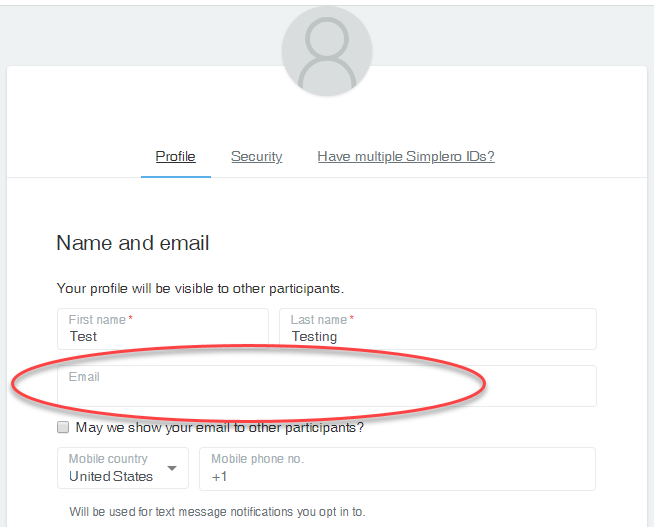

4-7. How do I change my email address?

- Login to your account here

- On the left-hand side of the page, click on "Your Profile"

3. Enter your new email address in the email box

4. Scroll to the bottom of the page and click on "Save Changes" button

4-8. What is your refund policy?

SI Course: refund will be provided if requested in the first 30 days. There are no refunds after 30 days from the date of purchase.

SI Platform Monthly Subscription: there are no refunds. You can cancel at anytime.

SI Platform Annual Subscription: there are no refunds. Subscriptions can be cancelled after 12 month commitment. If you are ensure to commit for 12 months try out the 14-day free trial first.

There is no refund at all on SI Platform subscriptions. If you have any problems accessing the Platform please use our Contact Page to notify us immediately so we can resolve the issue.

SI Personal Assessment Call: You can cancel by providing notification up to 24 hours prior to your scheduled call, and receive a full refund.

For any cancellation made with less than 24 hours notice, you will receive an 80% refund. You can reschedule up to 24 hours prior to your scheduled call. There are no refunds for no-shows, or after the call has taken place.

By making a purchase, you agree to all Terms of Use and this Refund Policy including that you agree to not file a charge back for any services rendered, or for digital products that have been delivered. Cancelling or removing the credit card on file does not cancel your subscription and violates the terms of the agreement, you need to login to your account and cancel your subscription.

Refund policy and Terms of Use is available here.

4-9. How do I request a refund?

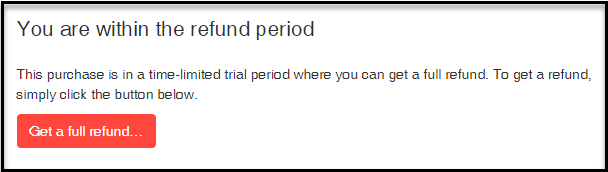

- Login to your account here

- Under "Your Purchases" click on Simply Investing Course or Basic Access

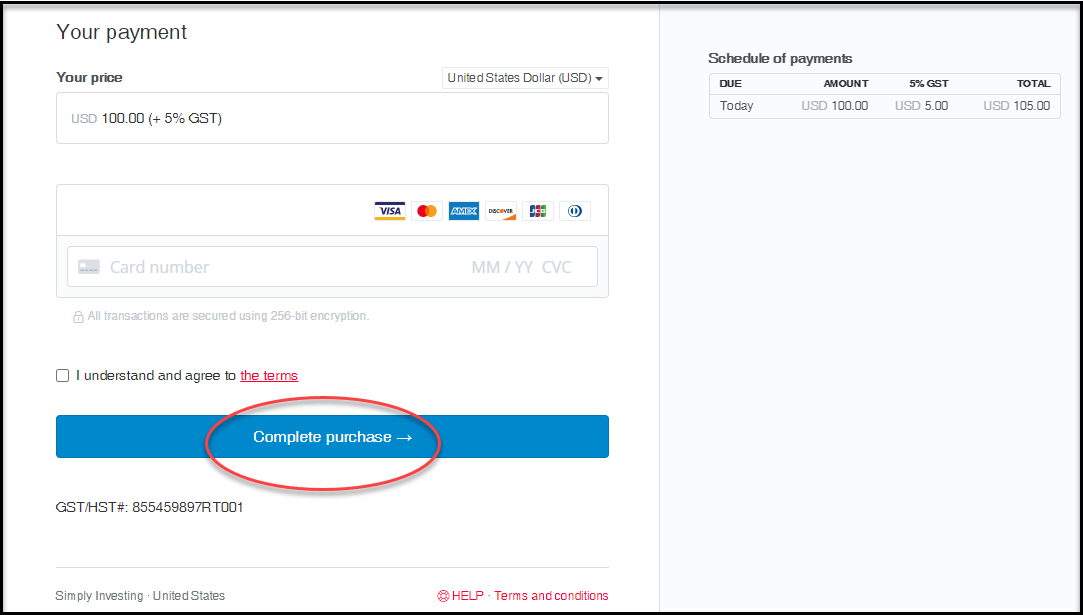

3. On the right-hand side, click on the "Manage Payment" button (see below for an image of the button):

4. Click on "Get a full refund", this option is not available after 30 days of purchase (see refund policy).

You will receive a refund and you will also receive an email confirming your refund.

4-10. I bought the Basic Package, how do I access the Simply Investing Course?

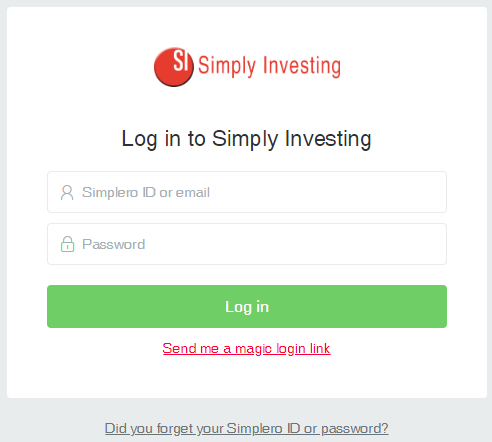

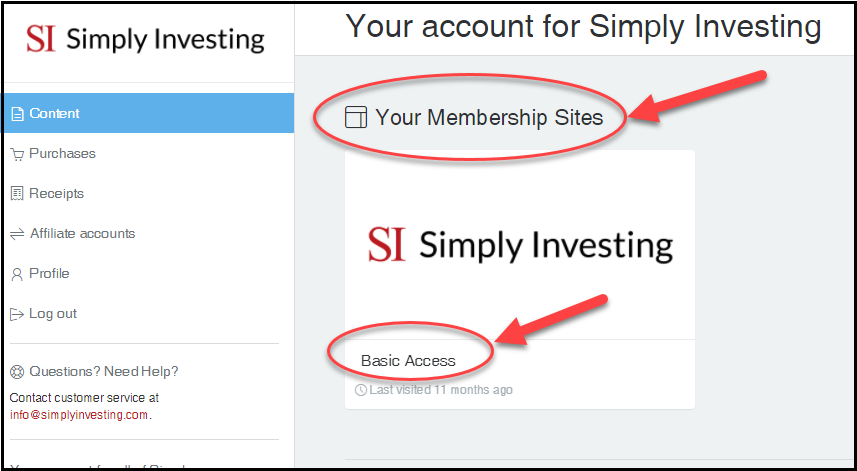

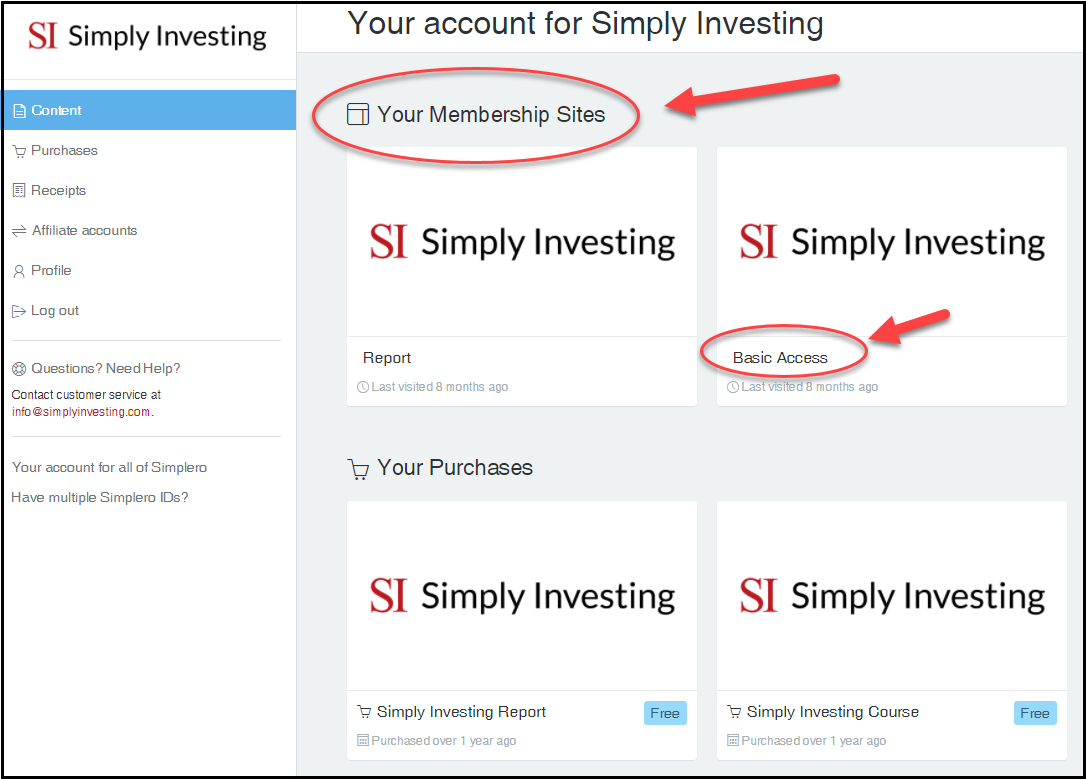

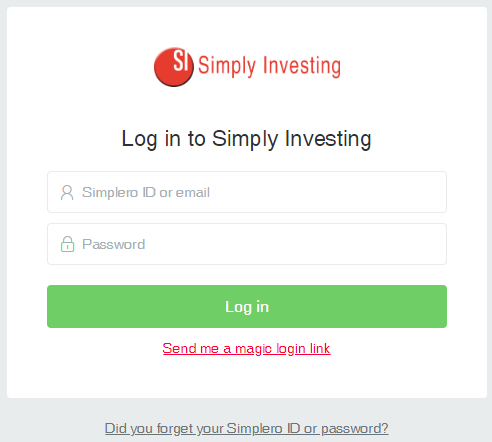

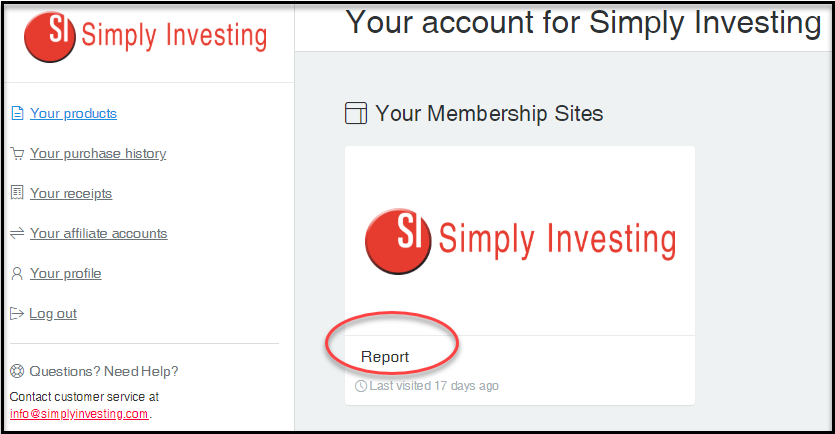

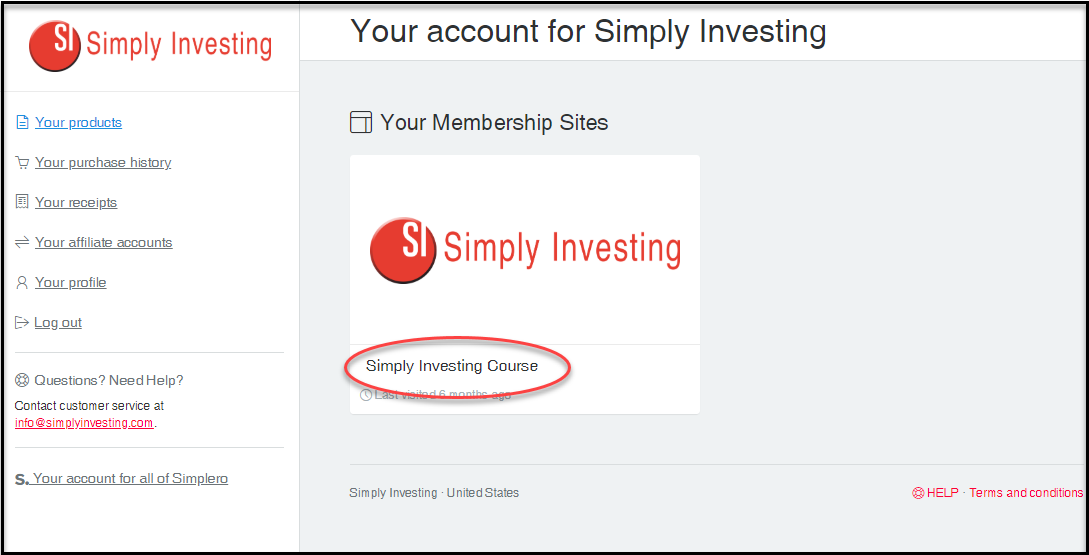

- Login to your account here, enter your SimpleroID and Password:

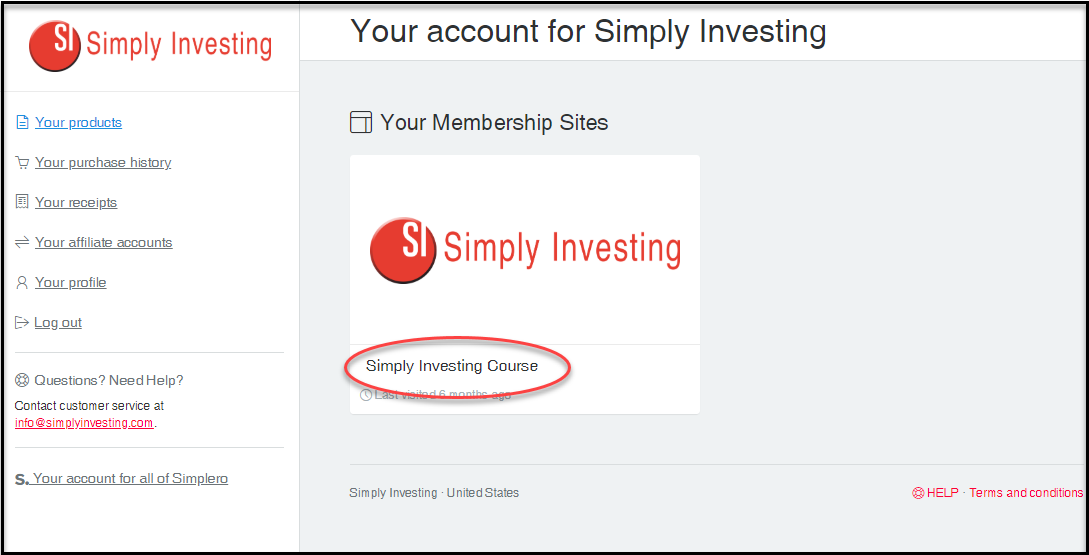

2. Under "Your Membership Sites" click on Basic Access or Simply Investing Course

If you also subscribe to the SI Report your screen may look like this:

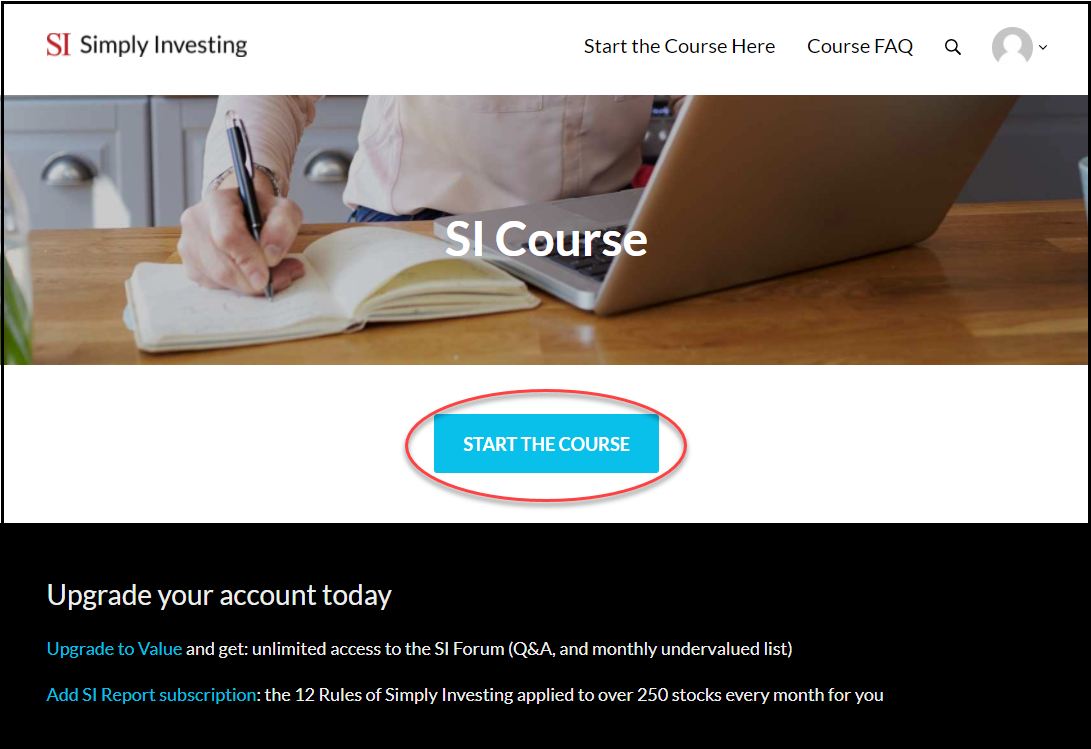

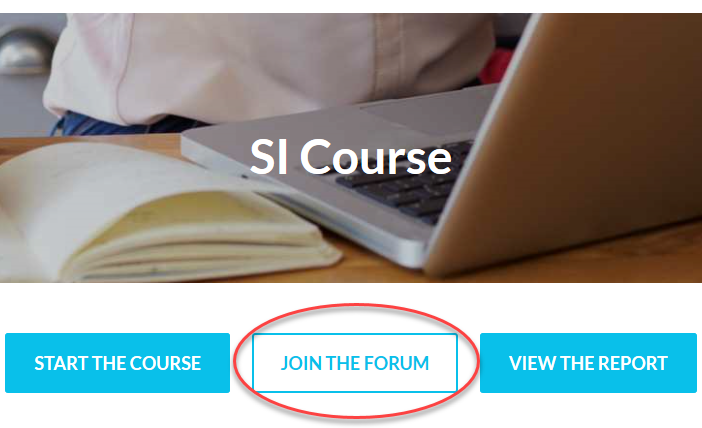

3. Click on "Start the Course" button

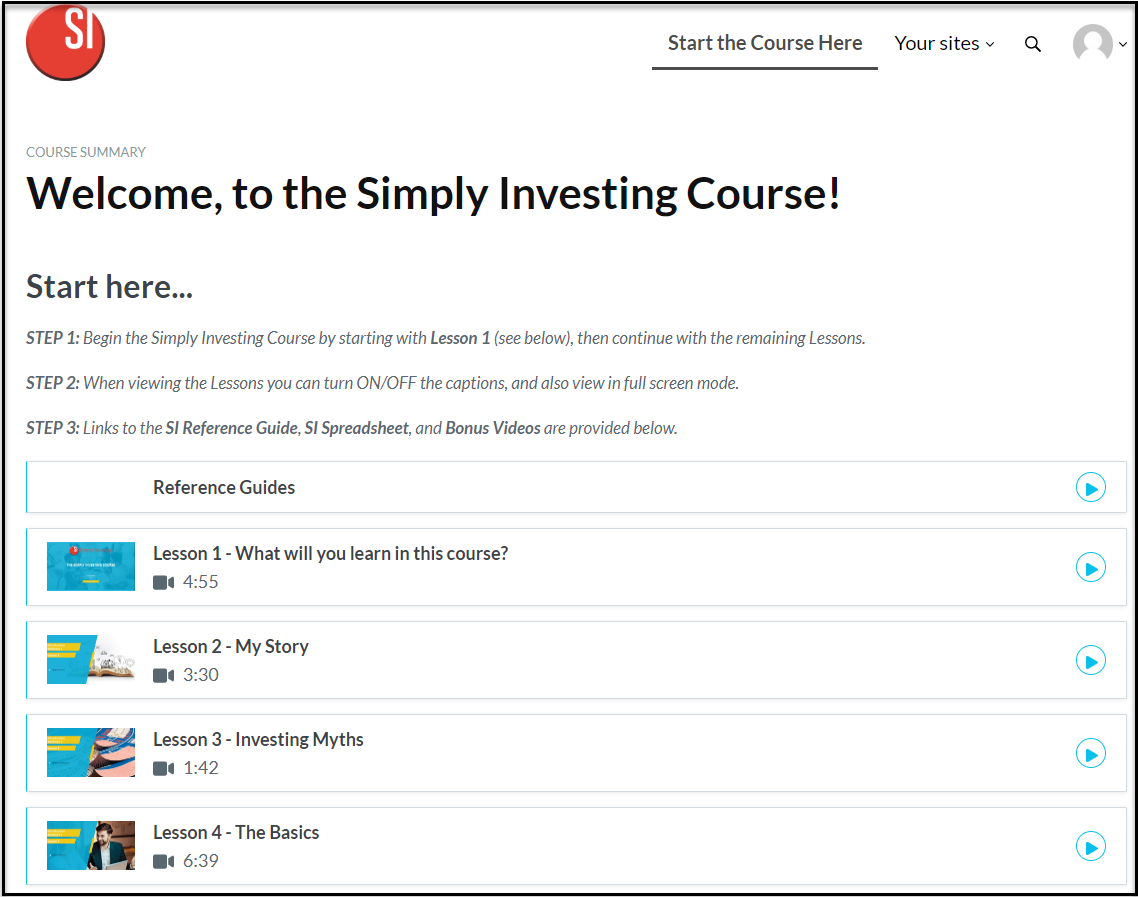

4. The Course lessons will be displayed on the page:

4-11. I bought the Value/Premium Package, how do I access the Simply Investing Course?

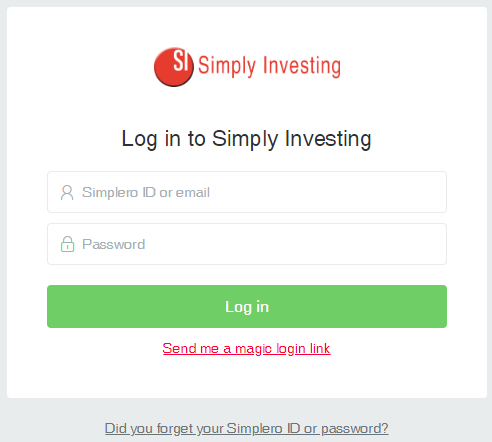

- Login to your account here, enter your SimpleroID and Password:

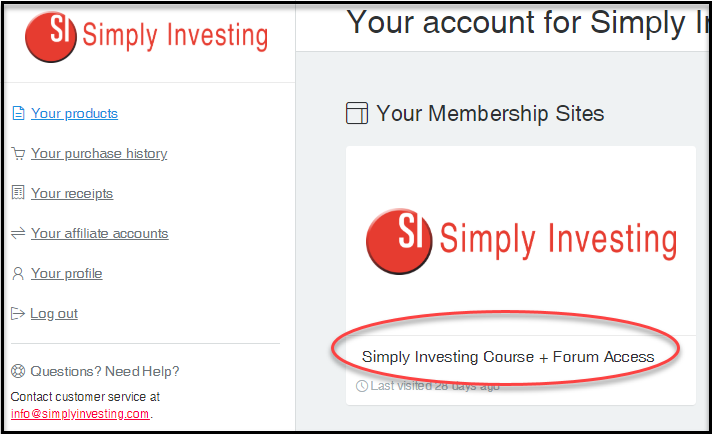

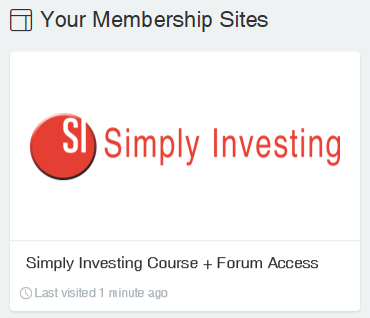

2. Under "Your Membership Sites" click on Simply Investing Course + Forum Access

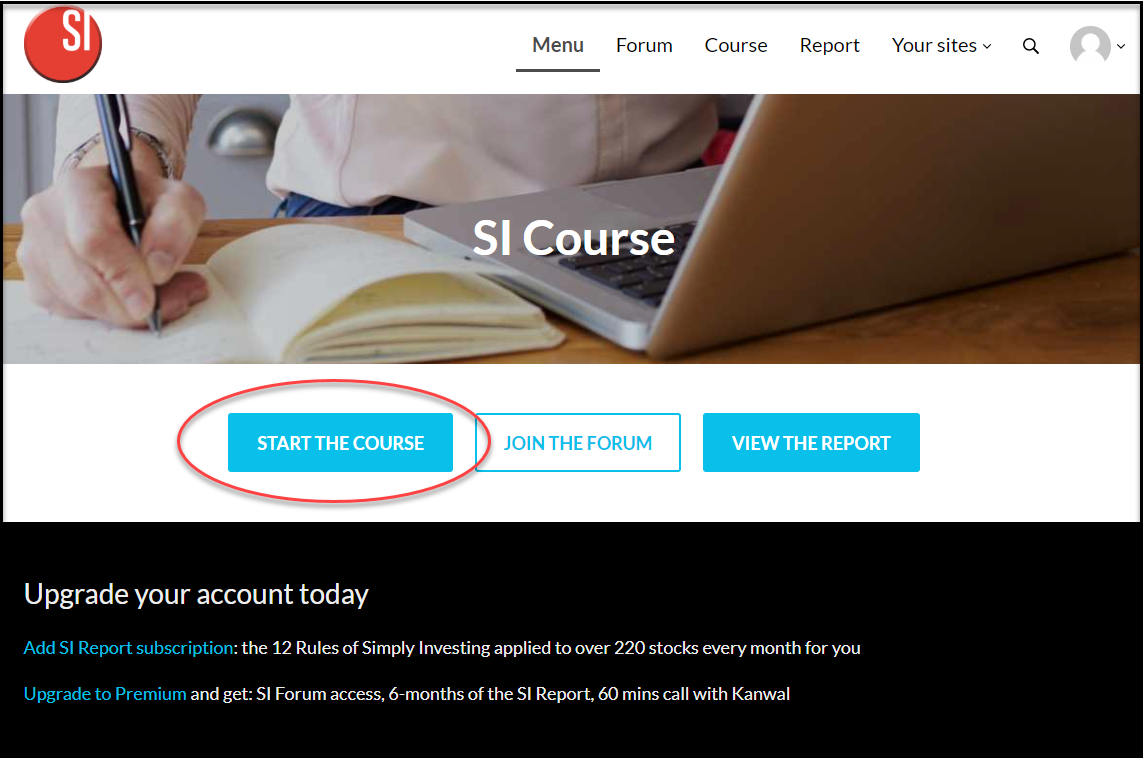

3. Click on the "Start the Course" button

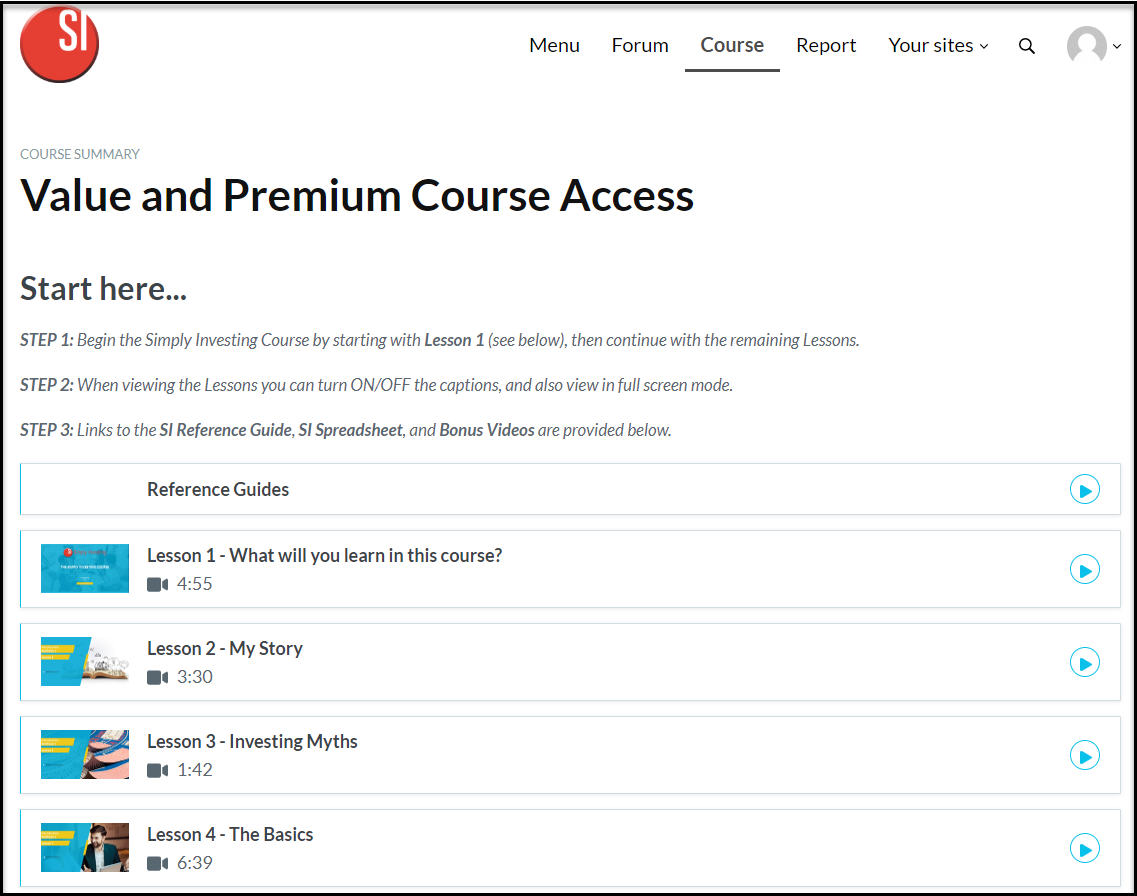

4. The Course lessons will be displayed on the page:

4-12. How do I access the Simply Investing Platform?

- Login to your account here, enter your SimpleroID and Password:

2. Under "Your Membership Sites" click on Simply Investing Report & Analysis Platform

3. The Platform page will be displayed, or if you purchased the Premium Package, click on the "Access Platform" button

4-13. How do I access the Simply Investing Forum?

- Login to your account here

- Under "Your Membership Sites" click on "Simply Investing Course + Forum Access"

3. Click on the "Join The Forum" button

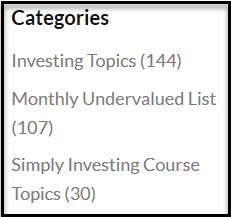

4. On the right-hand side of the page, select the Category of messages you would like to view

4-14. Why can I not access the Simply Investing Forum?

Access to the Forum is only available if you have purchased the Value or Premium Package.

You can upgrade from the Basic Package at anytime by logging into your account.

If you have purchased the Value or Premium Package and you still cannot access the Forum please contact us.

4-15. Why can I not access the Simply Investing Platform?

Access to the Platform is only available to Platform subscribers and to the following clients:

- Basic Course Package includes 1 month free access to SI Platform

- Value Course Package includes 2 month free access to SI Platform

- Premium Course Package includes 6 month free access to SI Platform

Platform access is also removed if your renewal payment fails to process. This could happen due to a change in your billing information.

4-16. I purchased the Premium Package, how do I book my 1-hour call with Kanwal?

First complete the Simply Investing Course (all 27 lessons), then use the contact page to schedule your call.

4-17. How do I cancel my subscription to the Simply Investing Platform?

This feature is not available for any subscriptions that were started prior to December 12, 2019. If you became a subscriber prior to December 12, 2019 please contact us in order to cancel your subscription.

If you became a subscriber after December 12, 2019, follow these steps:

1. Login to your account:

2. Under "Your Subscriptions" click on "Simply Investing Report":

3. Click on Manage Payment:

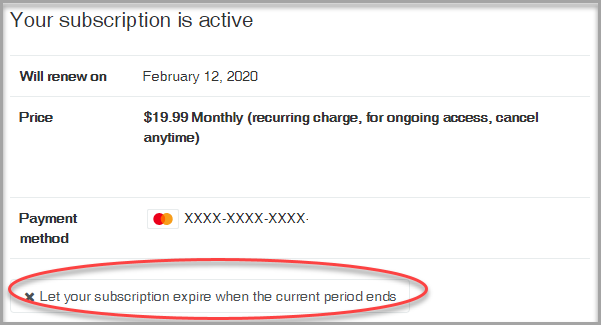

4. Click on "Let your subscription expire when the current period ends", your access remains active until the current period, after the current period your subscription will be cancelled and your will no longer be charged.

4-18. What is the best way to contact Simply Investing (email, phone, twitter, or Facebook)?

Email is the best way to contact Simply Investing. You can also use the contact page get in touch with us.

Our social media accounts are not monitored every day.

Response time can take up to 2 business days, but we do our best to reply to you as soon as possible.

4-19. I bought the Course (or Platform) why did I not receive any email on how to access my purchase?

You should receive an email immediately after your purchase. This email will contain your user ID and the link to access your purchase.

There can be 2 reasons why you did not receive your email:

- The email may have automatically gone into your Spam or Junk folder, so check there first.

- You may have accidentally typed in your email address incorrectly in the checkout page. In that case please contact us so we can correct your email address and resend you the welcome email.

4-20. I accidentally bought the Course/Report in the wrong currency, how can I fix this?

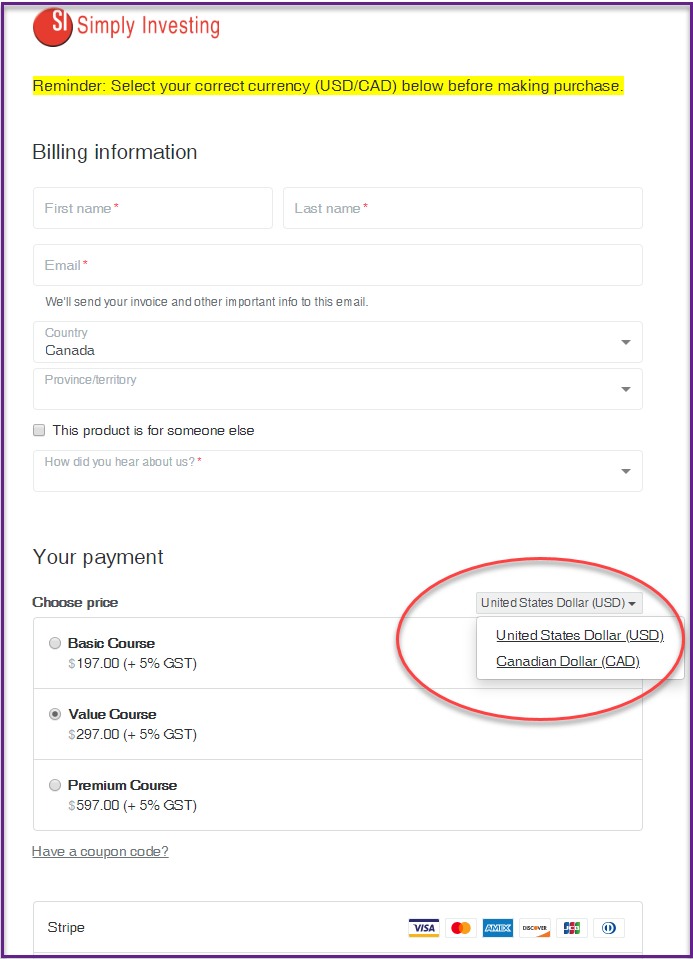

Did you accidentally make a purchase in USD but wanted to pay in CAD? Here are the steps to correct this purchase:

Step 1: Request a refund within the first 30 days of purchase, follow the steps here to request an immediate refund.

Step 2: Make a new purchase, and remember to select the correct currency. The default currency is USD, so you have to make the correct selection on the order page as shown here:

The instructions listed above are the same for SI Course and Report purchases.

4-21. I purchased the Basic Course Package, how can I upgrade to the Value Package?

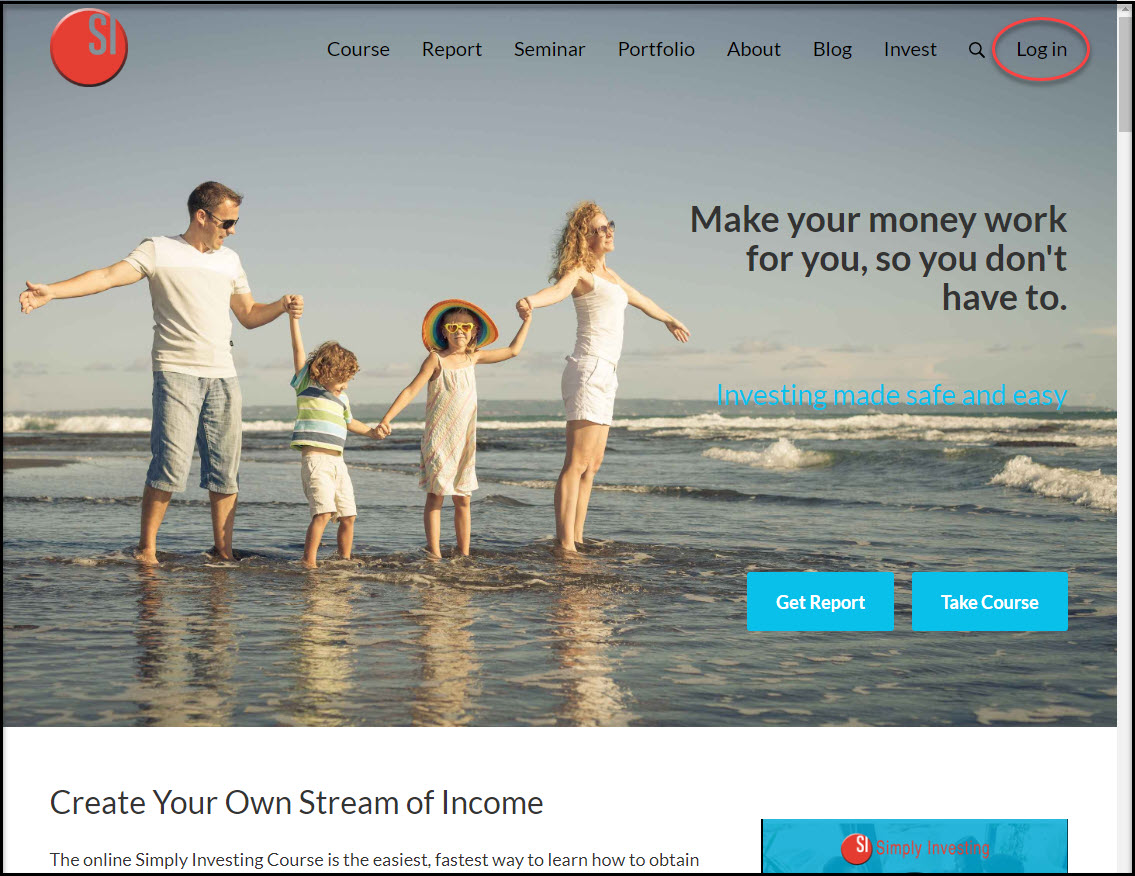

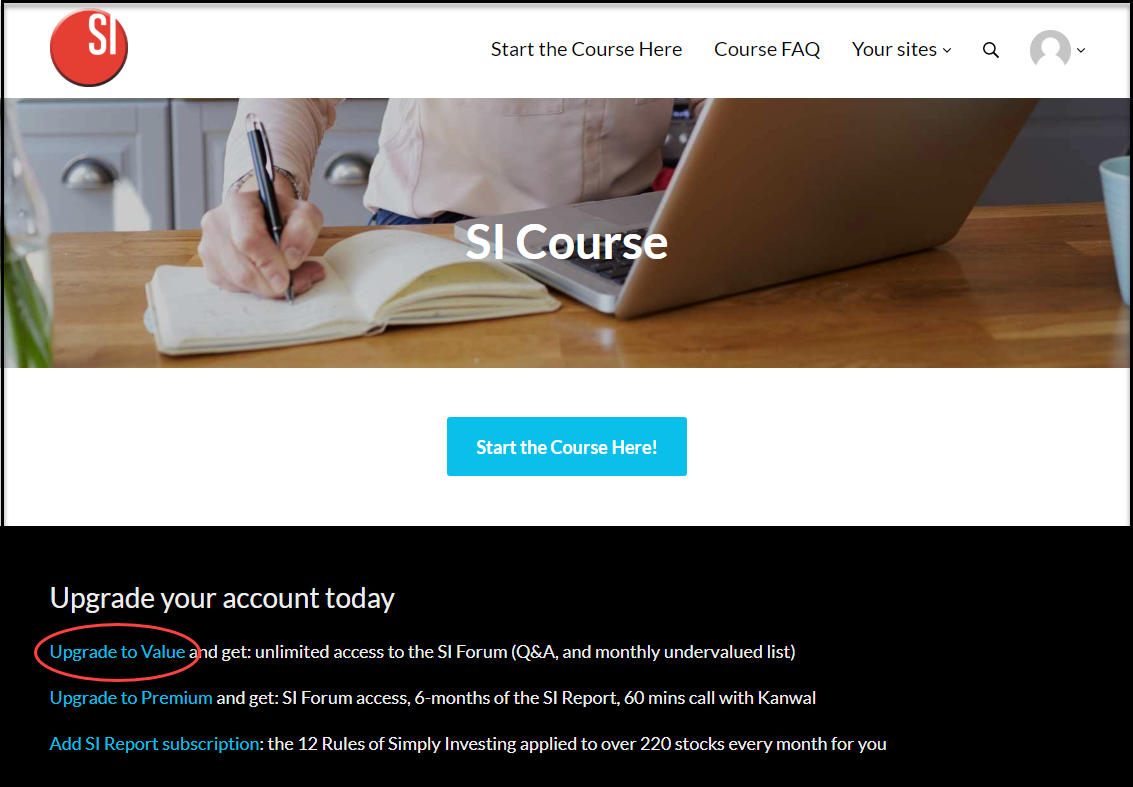

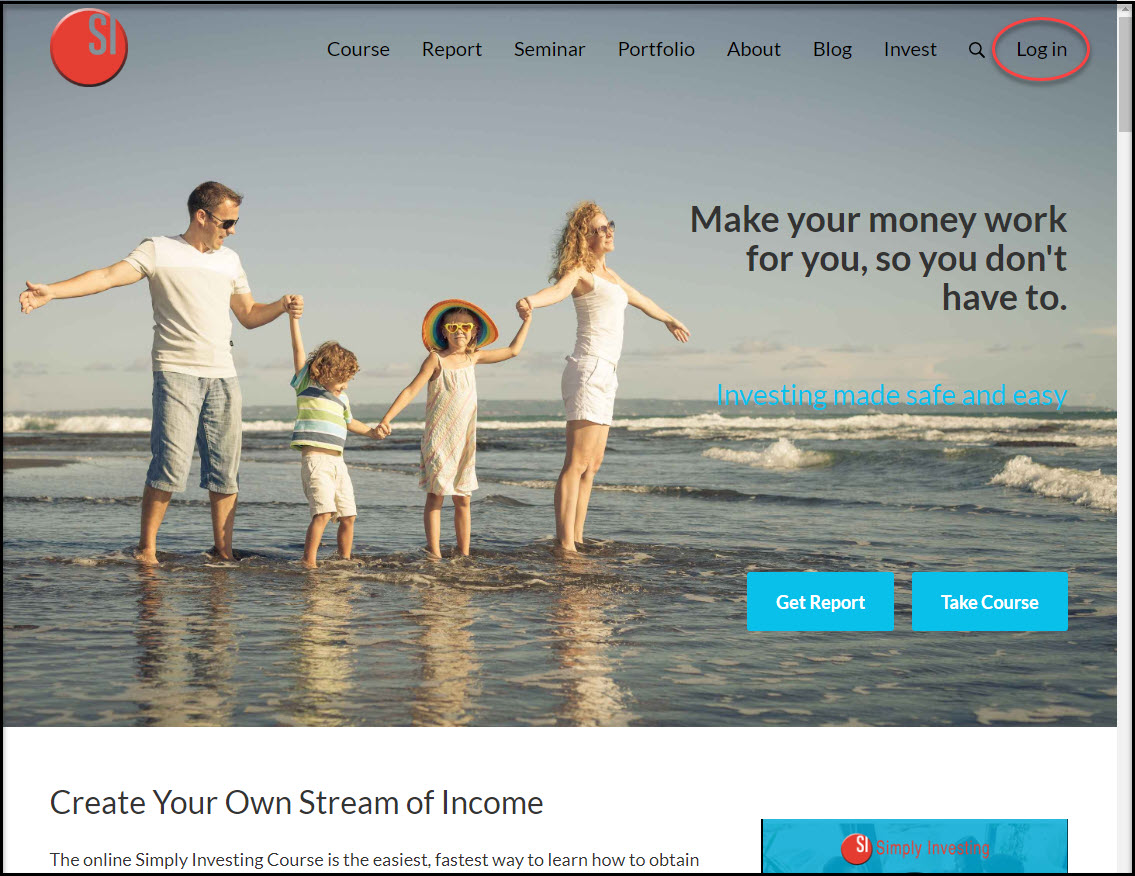

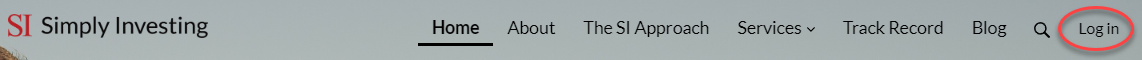

1. From the Simply Investing website, on the top right-hand corner click on "Log In":

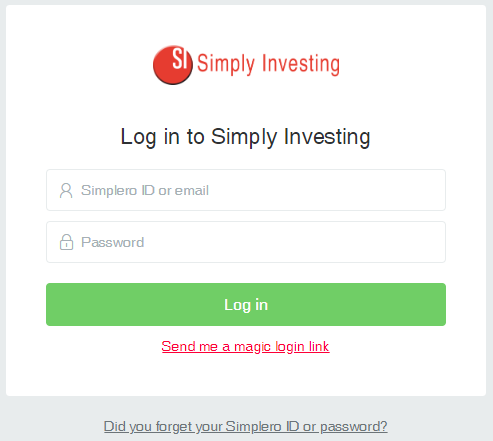

2. Enter your userID and password to login to your account:

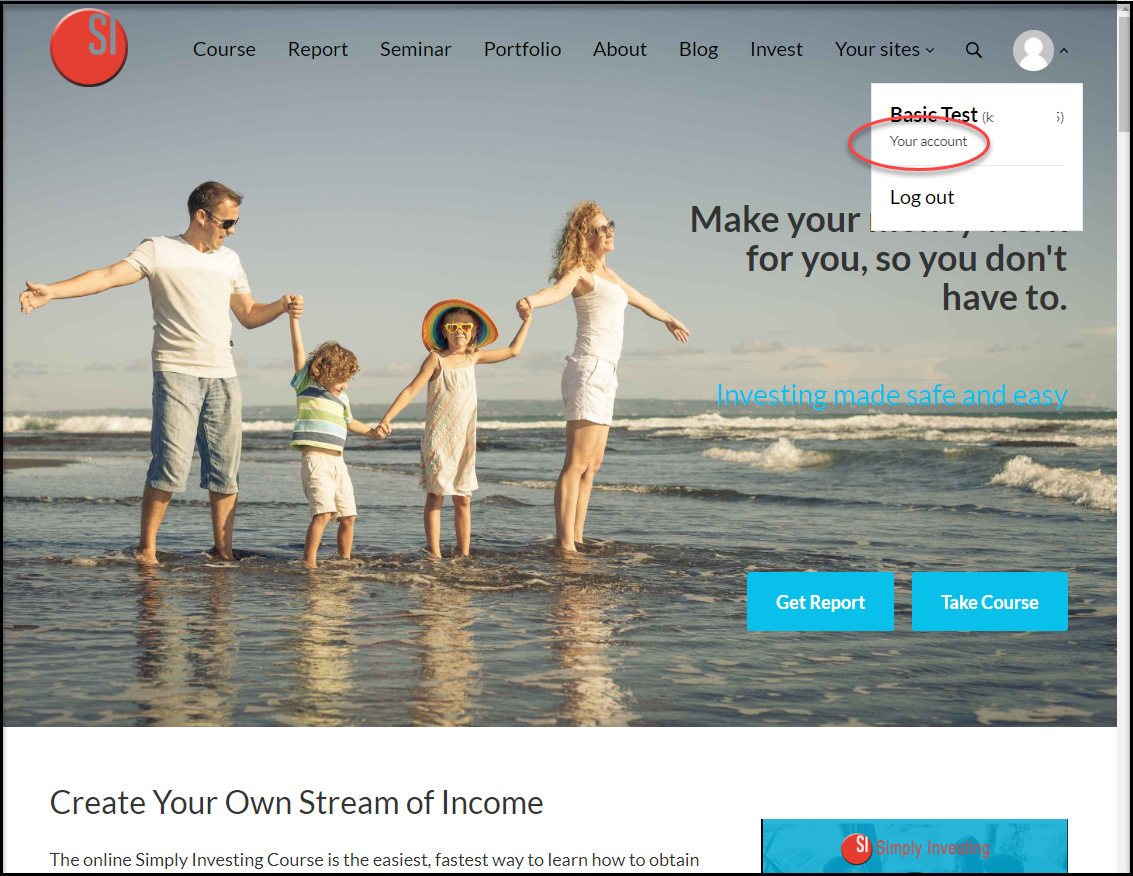

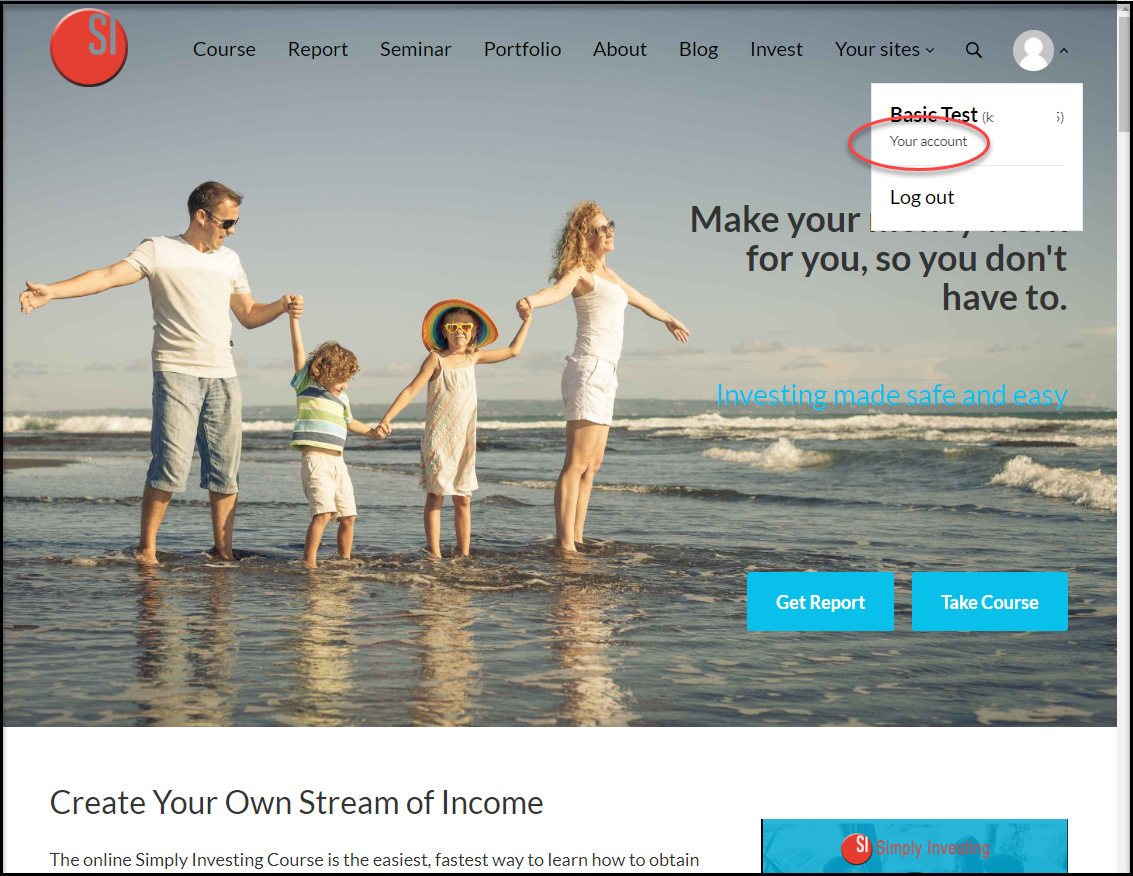

3. At the top right-hand corner click on the person icon, then click on "Your account":

4. Under your Membership Sites, click on "Simply Investing Course":

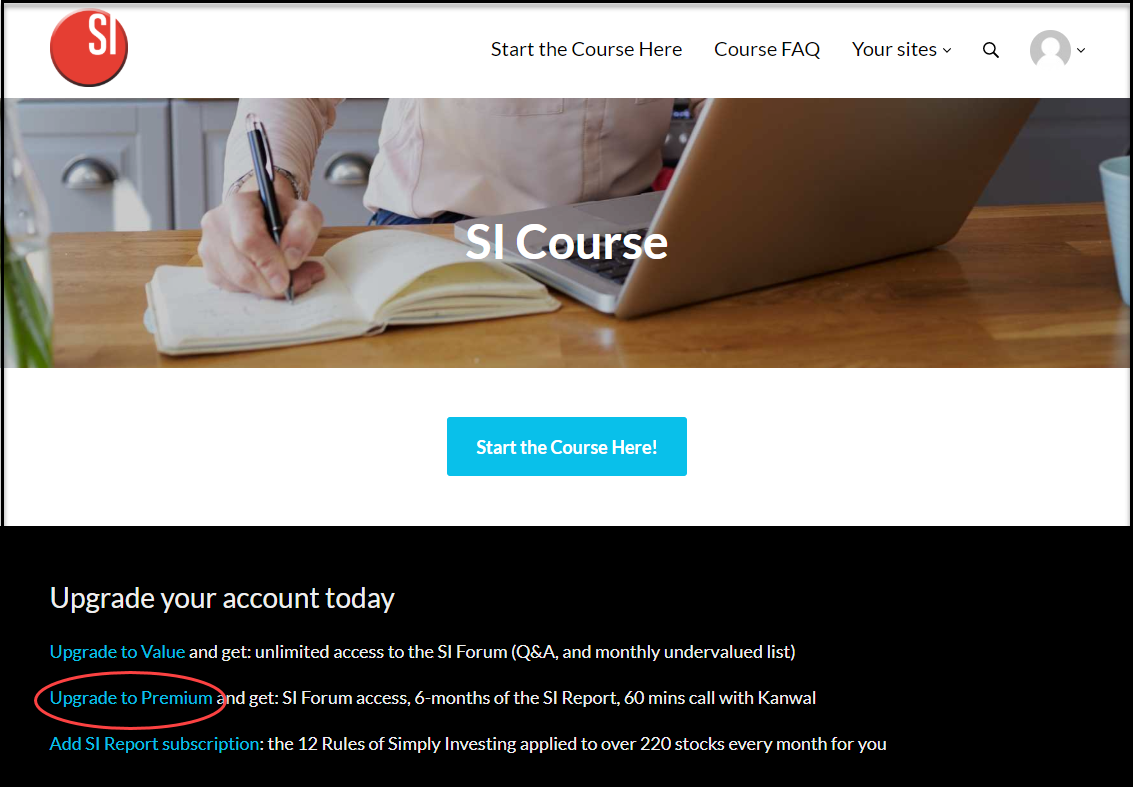

5. Click on "Upgrade to Value":

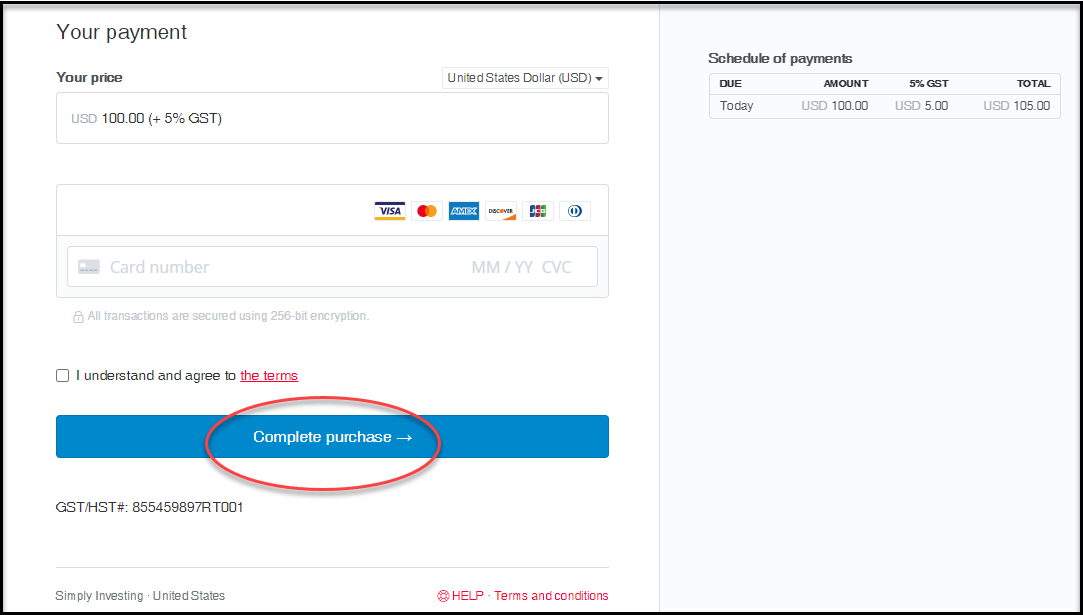

6. Select the correct currency, enter your billing information and click on "Complete purchase":

7. You may have to logout and log back in, in order to access the new content in the Value Package.

4-22. I purchased the Basic/Value Course Package. How can I upgrade to the Premium Package?

1. From the Simply Investing website, on the top right-hand corner click on "Log In":

2. Enter your userID and password to login to your account:

3. At the top right-hand corner click on the person icon, then click on "Your account":

4. Under your Membership Sites, click on "Simply Investing Course":

5. Click on "Upgrade to Premium":

6. Select the correct currency, enter your billing information and click on "Complete purchase":

7. You may have to logout and log back in, in order to access the new content in the Premium Package.

4-23. When I am logged into my SI account, I cannot see the Blog. How do I access the Blog?

When you are logged into your Simply Investing account, you are on a separate website, and based on what you purchased you may only have access to the SI Course, SI Report or both sites.

Here are two options to access the Blog page, About page, Invest page or any other page on the corporate website at SimplyInvesting.com:

- Open a new browser, or new browser tab and go directly to SimplyInvesting.com

- Or, if you do not wish to open a new browser or browser tab, then you will have to logout of your account, and go directly to SimplyInvesting.com

Once you are on the corporate website at SimplyInvesting.com you can access the Blog or any page on the main website.

4-24. Where do I login to access the SI Course or SI Platform, I lost my welcome email?

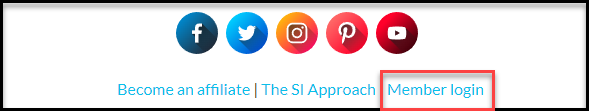

From our main website, you can always click on the top right-hand corner "Log In", or at the bottom of the webpage (footer) "Member login" to access your account.

4-25. I have more questions that aren’t on this list. Where can I go to get answers?

If you are a SI Platform subscriber: review the FAQ page for subscribers after you login the Platform.

If you purchased the Simply Investing Course: review lesson 27, it contains a Q&A section, the SI Guidebook also has an FAQ section

For all other inquires use the contact page get in touch with us.

Still Need More Answers?

We welcome your comments and questions, feel free to contact us using the form below.

Simply Investing Updates

Sign up for our free monthly newsletter, and be the first to receive original content to help you become a successful investor. Start earning more today!