Blog

Dividend Investing Talk with Keith from DivHut

I recently had the honor of interviewing Keith Park the blogger behind DivHut. Keith has been a dividend investor since 2007, and has traveled to over 32 countries. In this interview we discuss how Keith got started with dividend investing, how he selects dividend stocks, and what stocks look interesting to him right now. Let's get started with the interview!

I recently had the honor of interviewing Keith Park the blogger behind DivHut. Keith has been a dividend investor since 2007, and has traveled to over 32 countries. In this interview we discuss how Keith got started with dividend investing, how he selects dividend stocks, and what stocks look interesting to him right now. Let's get started with the interview!

Kanwal: Keith how did you get started with dividend investing?

Keith: I have been investing in stocks for many decades often buying and …

An Ode to Dividends - a Poem by ChatGPT

These days everyone is talking about ChatGPT. ChatGPT is a chatbot developed by OpenAI, it launched in November 2022 and quickly garnered attention for its detailed responses and articulate answers across many domains of knowledge.

These days everyone is talking about ChatGPT. ChatGPT is a chatbot developed by OpenAI, it launched in November 2022 and quickly garnered attention for its detailed responses and articulate answers across many domains of knowledge.

For fun I asked ChatGPT to write a poem about the benefits of dividends, below you will find the poem. Enjoy!

Dividends are a gift that keeps on giving,

A path to wealth that's worth pursuing.

They may not come in one big sum,

But in small bits, they add up to a handso…

5 Key Benefits of Long Term Investing in Dividend Stocks

Long-term investing in dividend stocks provides the following 5 key benefits:

Long-term investing in dividend stocks provides the following 5 key benefits:

-

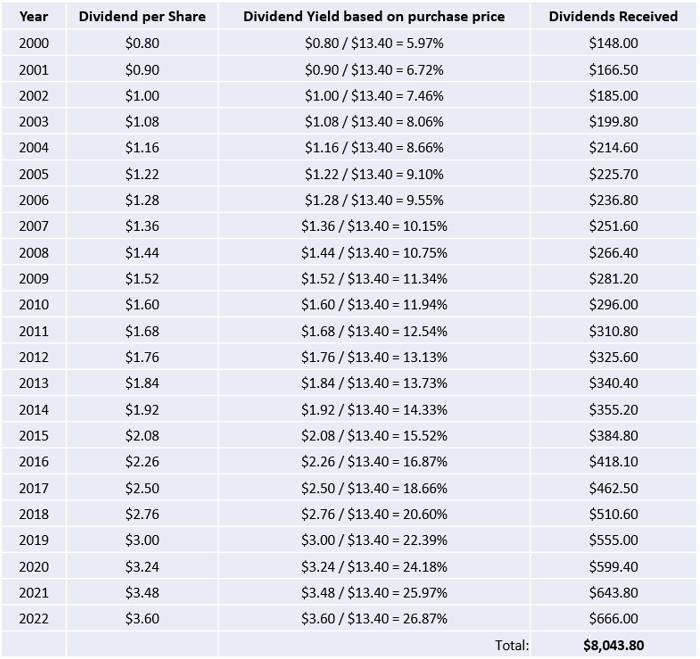

Passive income: One of the primary benefits of dividend investing is the ability to generate passive income. As long as the company continues to pay dividends, an investor receives regular payments that can help supplement their income. Here's my personal example with owning TC Energy:

In 2000, I purchased 185 shares in TRP for $13.40 each, for a total investment of $2479. Since then I have received over $8,0…

In 2000, I purchased 185 shares in TRP for $13.40 each, for a total investment of $2479. Since then I have received over $8,0…

What is a dividend trap, and how do you avoid it?

With recent declines in stock prices, dividend traps are becoming more prevalent. In this blog post I'll describe what is a dividend trap, it's potential downfalls, and how to avoid these traps. Before we begin, you need to understand dividend yield, and the dividend payout ratio.

With recent declines in stock prices, dividend traps are becoming more prevalent. In this blog post I'll describe what is a dividend trap, it's potential downfalls, and how to avoid these traps. Before we begin, you need to understand dividend yield, and the dividend payout ratio.

What is a dividend yield?

The dividend yield is simply the "annual dividend" divided by the "share price" expressed as a percentage, take a look at this example:

- Company ABCD

- Annual dividend = $1/share

- Share Price…

My Strategies For Dealing With a Down Stock Market

How do I handle my stock portfolio during a market downturn? How do I cope with seeing my stocks drop in value? Should I sell? Should I keep investing? These questions came up recently in the Simply Investing Forum. This blog post will answer these questions.

How do I handle my stock portfolio during a market downturn? How do I cope with seeing my stocks drop in value? Should I sell? Should I keep investing? These questions came up recently in the Simply Investing Forum. This blog post will answer these questions.

Focus on quality dividend stocks

In this blog post I will assume you are asking about your dividend stocks that you purchased when they passed the 12 Rules of Simply Investing (in other words quality stocks). I will ignore the following sit…

Do great stocks go on sale during a down market?

Do great stocks go on sale during a down market? The short answer is: yes! Warren Buffett has the patience, and discipline to invest in great stocks when they are priced low. In this article I'll provide you with examples of Buffett's investments, and give you 3 examples of great stocks that are undervalued today.

Do great stocks go on sale during a down market? The short answer is: yes! Warren Buffett has the patience, and discipline to invest in great stocks when they are priced low. In this article I'll provide you with examples of Buffett's investments, and give you 3 examples of great stocks that are undervalued today.

Is the stock market down?

It would seem like the stock market crash has already begun, here are some news headlines from this morning (September 1, 2022):

- S&P/TSX composite down mo…

How to beat inflation with dividend stocks

Does higher inflation have you worried? Are you concerned that your purchasing power will continue to decrease? Dividend stocks can help you beat inflation.

Does higher inflation have you worried? Are you concerned that your purchasing power will continue to decrease? Dividend stocks can help you beat inflation.

How much is inflation?

Bloomberg reported the following on July 13, 2022 regarding US inflation: "The consumer price index rose 9.1% from a year earlier in a broad-based advance, the largest gain since the end of 1981." In Canada on July 20, 2022 CBC news reported: "Inflation rises again, to new 39-year high of 8.1%". As you can see inflatio…

Do you know how to avoid bad stocks?

It's important to know how to identify great stocks, but it's just as important to know how to identify bad stocks so you can avoid them. In this article I'll show you how to identify and avoid lousy stocks.

It's important to know how to identify great stocks, but it's just as important to know how to identify bad stocks so you can avoid them. In this article I'll show you how to identify and avoid lousy stocks.

Will the company be around in 20 years?

Think about the products and services provide by a company before you invest in it. Will those products and services still be in demand 20 years from now? If not, then don't invest your hard earned money in a company that might not be around for the …

Stock market crash got you worried?

Note: The share price and dividends for stock PG listed in this article are correct as of June 7, 2022.

Note: The share price and dividends for stock PG listed in this article are correct as of June 7, 2022.

Are you concerned about a stock market crash? Don't be worried, a market crash presents great investment opportunities if you know where to look.

Are we headed towards a market crash?

The current news doesn't look very promising:

- inflation is at an all time high

- we are seeing record oil prices at gas stations

- supply chain issues are also causing higher prices

- stock market volatility c…

The Top 3 Dividend Aristocrats Now

Written by Josh Arnold for Sure Dividend

Written by Josh Arnold for Sure Dividend

When it comes to finding ways to compound wealth over time, we believe the best way is to buy high-quality dividend stocks, reinvest dividends, and hold them for the long-term. This strategy has been proven to beat the broader market over time, provided the stocks selected can withstand threats from competition and economic recessions.

When searching for high-quality dividend stocks, there are few better places to start than the Dividend Aristocrats. In…