The 2nd way to make money

The second way to make money with stocks is to collect the dividend. A dividend is money you receive from a company just for owning their shares. For example if a company is paying $1 share and you own 1000 shares you will receive $1000 each year for as long as you own those shares and as long the company continues to pay the dividend. You can spend your dividend money or re-invest it if you wish.

How much money can you make with dividends?

The amount of the money you receive from dividends depends on three things:

- How many shares you own

- How much of a dividend a company is paying per share

- How quickly a company increases its dividend

Click here to download our Excel spreadsheet to estimate how much money you can make.

What are some real-life examples of dividends earned?

I will share with you my 3 personal examples with stocks that I still own and earn dividends with.

- I purchased 185 shares in TRP.TO at $13.40 each in 2000

- I purchased 125 shares in CM.TO at $73.90 each in 2005

- I purchased 144 shares in JNJ at $62.67 each in 2007

Total amount invested:

TRP.TO: $2479

CM.TO: $9237

JNJ: $9024

Total: $20,740

Total amount of dividends received as of today (Nov 20, 2020):

TRP.TO: $6457

CM.TO: $8043

JNJ: $5531

Total: $20,031

As you can see $20,740 invested has resulted in $20,031 in dividends received so far. The risk to the initial investment has almost gone down to zero.

Using today's (Nov 20, 2020) share price the total value of the investment (including dividends) is: $65,236

What is the secret to dividend investing?

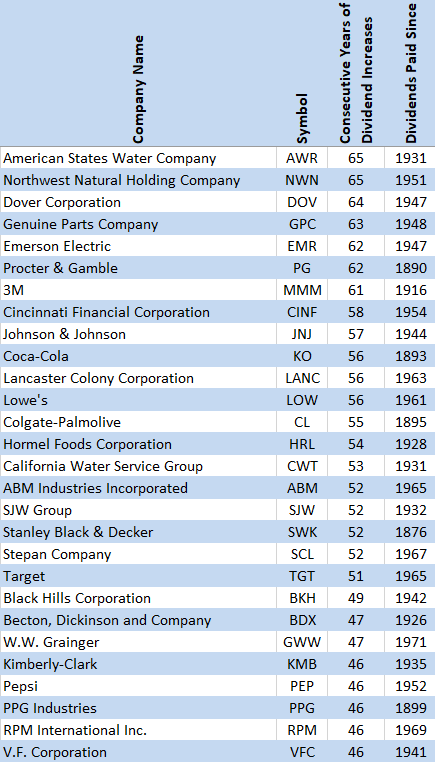

The secret to dividend investing is dividend increases. Quality companies increase their dividend each year, have a look at some examples:

A dividend increase equals more money in your pocket. Also important to note that there are some companies in the above table that have been paying dividends since the 1800's.

Is financial freedom possible with dividends?

Yes, financial freedom is possible with dividends. By starting to invest early you can build a portfolio of stocks that will provide you with growing passive income each year. The dividends will eventually cover your living expenses, without dividends you are only hoping for the stock price to go up. But, hope will not cover your living expenses only dividends can do that.

Should I just go out and immediately invest in dividend stocks?

I'm here to help

I can help you to start investing today, why re-invent the wheel when you can learn from my 20-years of being in the stock market. I've witnessed first hand the ups and downs of the market, and I know what it's like to start investing your hard earned money. I created the 12 Rule of Simply Investing to help you get started right away, so you don't have to wait on the sidelines any longer. The sooner you start investing the sooner you will be on your path to financial freedom.

Did you enjoy reading this article? If so, I encourage you to sign up for my newsletter and have these articles delivered via email once a month … for free!

There are two ways to make money with stocks, one is based on hope the other is based on data.

There are two ways to make money with stocks, one is based on hope the other is based on data.

0 comments

Leave a comment