How should you invest during uncertain times?

How should you invest during uncertain times? Is it better to do nothing? Or is there another way to continue building a solid portfolio that generates passive income for you?

How should you invest during uncertain times? Is it better to do nothing? Or is there another way to continue building a solid portfolio that generates passive income for you?

The cost of doing nothing

Fear might cause you to not invest. But generally this fear comes from a lack of knowledge -- not knowing how to invest, not knowing what to invest in, and not knowing that it is normal for stock markets to go up and down. Over the long-term, inflation will reduce your earning power and any money sitting in a bank account (not invested) will be worth less in the future.

What if you get unlucky, and you're hit immediately by a correction or a crash?

Tony Robbins covered this topic in his book "Unshakeable", and I could not have said it better myself:

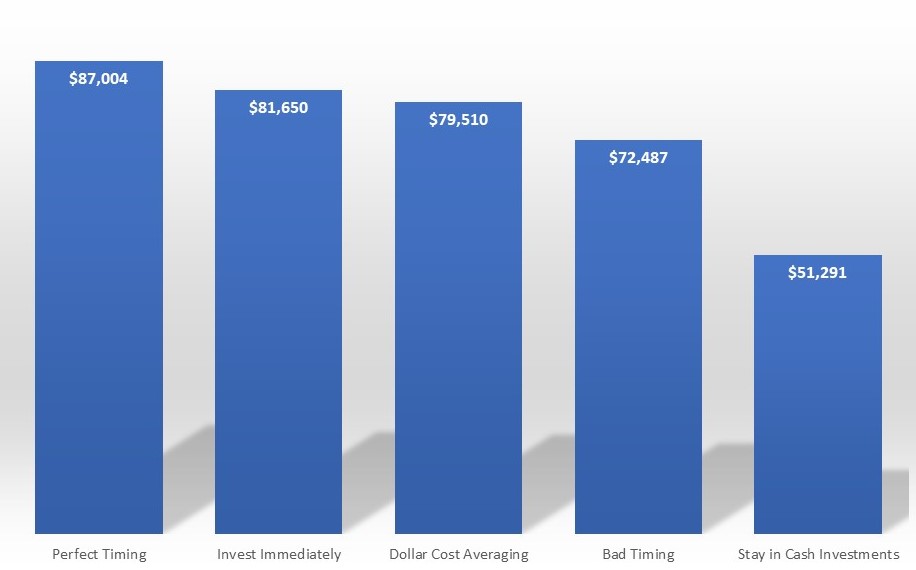

"What if you get unlucky, and you're hit immediately by a correction or a crash? As you can see in the chart below, the Schwab Center for Financial Research studied the impact of timing on the returns of five hypothetical investors who had $2,000 in cash to invest once a year for 20 years, starting in 1993.

“The most successful of these five investors - let's call her Ms. Perfect - invested her money on the best possible day each year: the day when the market hit its exact low point for that year. This mythical investor, who perfectly timed the market for 20 years running, ended up with $87,004. The investor with the worst timing - let's call him Mr. Hapless - invested all of his money on the worst possible day each year: the day when the market hit its exact high point for that year. The result? He ended up with $72,487.

“What's striking is that, even after this 20-year run of spectacularly bad luck, Mr. Hapless still made a substantial profit. The lesson? If you stay in the market long enough, compounding works its magic, and you end up with a healthy return -- even if your timing was hopelessly unlucky. And you know what? The worst-performing investor wasn't the unlucky one, but the one who stayed on the bench, the one in cash: he ended up with only $51,291."

What if you don't know the perfect time to invest?

What if you, like most people, do not know the perfect time to invest, or even when to avoid the worst time to invest? Then just do what Mr. Immediate did. He invested his $2,000 immediately at the beginning of each year. After 20 years Mr. Immediate ended up with $81,650.

Start investing, don't wait

As you can see from Tony Robbins’ example, even if you chose the "wrong" time to invest you were still ahead of everyone who chose not to invest. So, you can be Ms. Perfect, Mr. Immediate, or Mr. Hapless and you will do fine. Just do not wait on the sidelines hoping to start investing "someday".

Knowledge reduces your fear

Knowing what to invest in, when to invest, and how to react to uncertain times will make you a better investor and reduce your fear of investing. No one knows how long this market downturn will last, and no one knows when the market will hit bottom. Keep your eyes open to quality stocks that are undervalued (priced low) and invest in small portions over a period of time.

I'm here to help

I can help you to start investing today. Why reinvent the wheel when you can learn from my 20 years of being in the stock market? I have witnessed first hand the ups and downs of the market and I know what it's like to start investing your hard earned money. I created the 12 Rules of Simply Investing to help you get started right away, so you do not have to wait on the sidelines any longer.

1 comment

Interesting read! And you raised some good points! Thank you for sharing those to us!

Leave a comment