Can you earn $4000/year in dividends with only $25K invested?

Reading time: 4 minutes

How can you earn $4,000/year with only $25,000 invested? If the average dividend yield for blue-chip stocks is around 2%, a quick calculation would tell you that you need at least $200,000 in order to make $4,000/year in dividends, here's the quick math:

How can you earn $4,000/year with only $25,000 invested? If the average dividend yield for blue-chip stocks is around 2%, a quick calculation would tell you that you need at least $200,000 in order to make $4,000/year in dividends, here's the quick math:

$200,000 x 2% = $4,000

Therefore, how can you earn $4,000/year with only $25,000 invested? Keep reading on how this is possible.

Two things are important

When it comes to dividend investing two things are important:

- the amount of time you stay invested, and

- dividend increases

When you combine both time and dividend increases the results can be phenomenal.

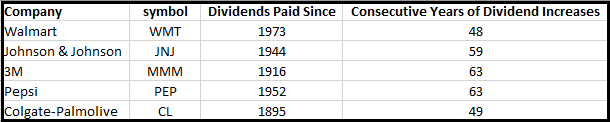

Dividend increases are outside of your control, but you can look at history as your guide, Take a look at these 5 companies:

You can see from the table above that these companies have been paying dividends for more than 49 years, and they have been increasing their dividends consecutively for over 48 years.

More money in your pocket

Each dividend increase puts more money into your pocket. Remember dividends are deposited as cash into your trading account, you can spend the money if you wish or re-invest it.

Time + Increasing Dividends

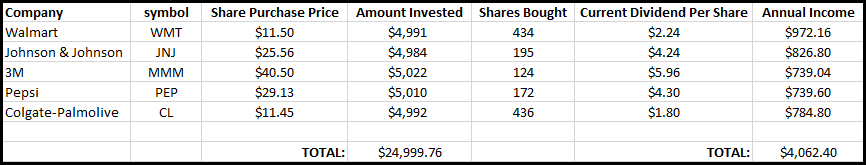

Now, let's see what happens when you combine time (in this example 25 years) and dividend increases. As you can see in the table below, a total of $24,999.76 was invested 25 years ago in 5 companies. Today those 5 companies are generating over $4,000 in dividends each year. This means every 5 years you would earn $20,000 in dividends.

More Dividends

Since these 5 companies have a history of increasing dividends, its very likely that next year that this portfolio would generate more than $4,062 in dividends, and more in future years.

16.2% Annual Return

In order to calculate the return on this initial investment you simply take the annual dividend income and divide it by the amount invested:

$4,062.40 / $24,999.76 = 16.2%

You read that correctly, that's an annual return of 16.2% just for holding on to those shares regardless of what happens to the stock price or the stock market. You cannot earn 16.2% return on your money today with bonds, term deposits, or in a savings account.

Dividend Investing

When is comes to dividend investing it pays to be patient. Remember time and dividend increases will put more money in your pocket. That's why its important to invest sooner than later. Your future self 25 years from now will thank you for the investing decisions you make today.

I'm here to help

I can help you to start investing today and focus on dividend stocks, why re-invent the wheel when you can learn from my 20-years of being in the stock market. I've witnessed first hand the ups and downs of the market, and I know what it's like to start investing your hard earned money. I created the 12 Rule of Simply Investing to help you get started right away, so you don't have to wait on the sidelines any longer. I also built the ultimate tool (that I wish I had when I started investing in1999) to help dividend investors focus on quality stocks for long-term growth. The sooner you start investing the sooner you will be on your path to financial freedom.

PS: Until March 6, 2022 you can enroll in my Simply Investing Premium Bundle, and for the first time join my live Q&A group calls this month.

The Premium Bundle also includes the following:

- SI Course

- SI Platform

- SI Forum

- SI Portfolio Tracker

- SI Spreadsheet

- Bonus videos

- 4 Live Q&A Group Calls this month

0 comments

Leave a comment