Why invest in dividend stocks?

Reading time: 4 minutes

Reading time: 4 minutes

Why are dividends important? Why do we focus so much on dividends? Dividends provide you with an immediate return on your investment while you hold on to your dividend-paying stocks, regardless of what happens to the stock price. Dividends are paid in cash to shareholders, you can spend your dividends or reinvest them into other dividend-paying stocks.

What is dividend yield?

For example, if a stock is trading at $30/share and the dividend is $1.50/share your dividend yield (or return on investment) will be 5%. The dividend yield is the dividend divided by the share price.

How much can I make?

Following the same example from above, let's say you purchase 300 shares in that company for a total investment of $9,000. While you hold on to those shares you will earn 5% each year for as long as the company continues to pay the $1.50 dividend. 5% of $9,000 is $450, you will receive $450 each year in cash (as dividends) regardless of what happens to the share price.

What if the stock price drops?

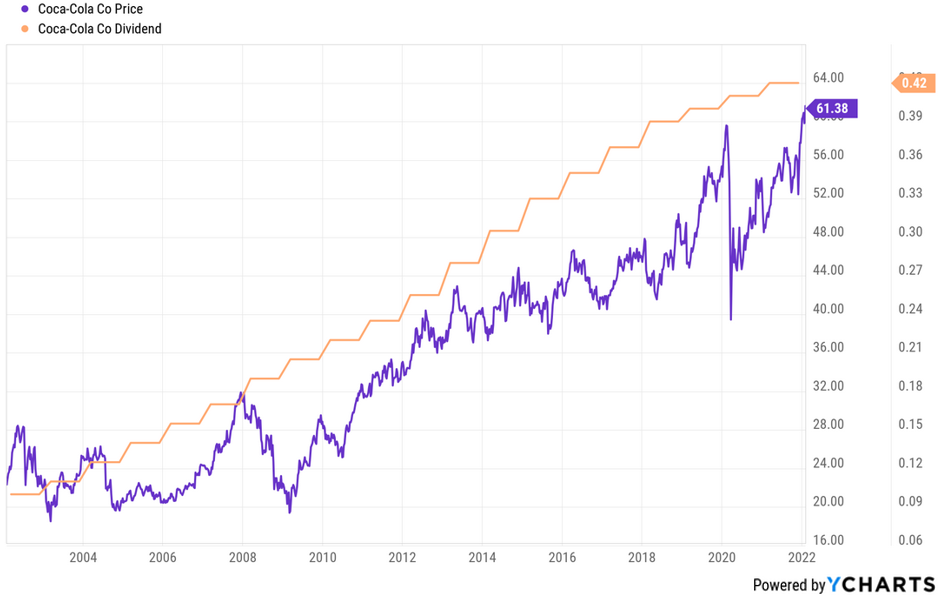

The dividend is not paid based on the share price, the dividend is paid per share. If you own 300 shares you will get $450 ($1.50 x 300 shares) in dividends each year. Take a look at the 20 year stock price chart for Coca-Cola below, notice that sometimes the stock price drops by more than $5, $10, or $15 yet the dividend (orange line) kept increasing each year.

How can the dividend increase when the stock price tanks?

How can a company like Coca-Cola keep increasing it's dividend even when its stock price drops? Because the dividend is not paid from the stock price, the dividend is paid from earnings. As long as a company is profitable and able to increase its earnings it can continue to pay dividends. In fact Coca-Cola has had over 59 years of consecutive dividend increases.

The Grande Dame of Dividends

Geraldine Weiss (known as "the Grande Dame of Dividends"), wrote in 1995 in The Dividend Connection (page 58) about dividends. Here are her own words about the significance of dividends:

“Don’t underestimate the importance of cash dividends. Dividends contribute significantly to shareholder value. When a dividend is increased, the stock becomes more valuable and more highly rated. Conversely, when a dividend is reduced, value is drained from the source of the investment and the stock becomes less attractive to investors.

Dividends not only instill shareholder confidence, they also attract new investors to the company and provide cash rewards that can compensate for the ever-present risks.

Value-oriented investors depend on the cash dividends not only to keep pace with inflation and improve their standard of living, but also as an indication of good corporate management. A company that pays cash dividends year after year and increases those dividends regularly is well managed. An ongoing dividend stream proves that a company is generating sufficient capital to cover expenses, pay the interest on its debt and reward its owners. When a dividend is increased, the stock owner knows without reading a balance sheet or annual report that their company is doing well.

Some investors live or die by earnings reports. Earnings are important, but who knows if the reported earnings are accurate? Earnings can be distorted for income tax purposes. They can be hidden or disguised behind vague bookkeeping terms such as cash flow, depreciation or inventory reserves. A clever accountant can make earnings appear good or not so good, depending on the season or objective.

There can be no subterfuge about a cash dividend. It is either paid or it is not paid. If it is paid, the shareholder knows that the company is making money. If it is not paid, no rhetoric can disguise the circumstances.”*

I'm here to help

I can help you to start investing today and focus on dividend stocks, why re-invent the wheel when you can learn from my 20-years of being in the stock market. I've witnessed first hand the ups and downs of the market, and I know what it's like to start investing your hard earned money. I created the 12 Rule of Simply Investing to help you get started right away, so you don't have to wait on the sidelines any longer. I also built the ultimate tool (that I wish I had when I started investing in1999) to help dividend investors focus on quality stocks for long-term growth. The sooner you start investing the sooner you will be on your path to financial freedom.

0 comments

Leave a comment