Should you stay away from companies with high debt?

Reading time: 3 minutes

Would you lend money to a friend who had little income and was swimming in debt? Of course not, because the likelihood of you getting your money back would be extremely low. The same is true for investing in companies which have high debt.

What's wrong with high debt?

What's wrong with high debt?

A company with high debt is going to have a hard time paying back its loan if the economy starts to tank. Companies with high debt will have a difficult time surviving downturns. We know from experience that downturns in the economy do occur, no one know when the next crash will happen and how long it will last. Therefore, as an investor you should always be prepared and build for yourself a resilient portfolio regardless of what happens in the economy.

What type of debt should you look at?

In the Simply Investing Course and Platform we look at the Long-term Debt to Equity Ratio, here's the formula:

Long-term Debt to Equity Ratio = (Long-term debt) / (Shareholder’s Equity)

Long-term debt is also covered in Rule #8 as part of the 12 Rules of Simply Investing.

Which companies are carrying high debt right now?

Here are some companies with high debt right now:

- Sysco (SYY): 636%

- Churchill Downs (CHDN): 579%

- Clorox (CLX): 512%

- Ford (F): 266%

- Pepsi (PEP): 234%

Contrast the above large debt numbers with companies like these:

- Columbia Banking (COLB): 1.8%

- Everest Re (RE): 15%

- Aflac (AFL): 24%

- MetLife (MET): 25%

- Reliance Steel (RS): 28%

Lower debt is better

All things considered equal you should invest in a company with lower debt. Lower debt is one of the factors that demonstrate that a company is financially healthy and properly managed. No one knows when the next recession will come, but financially healthy companies will be better suited to survive economic downturns.

How do I calculate debt?

As mentioned above here is the formula for calculating debt:

Long-term Debt to Equity Ratio = (Long-term debt) / (Shareholder’s Equity)

You can use free resources like Yahoo Finance, MSN Money, or a company's annual report to obtain the data you need, here are the steps:

1. View the company's Balance Sheet, in this example I'll use Walmart (WMT), and Yahoo Finance to get the data

2. Looking at the most recent Balance Sheet for WMT you'll see these numbers:

Long-term debt = 41,194,000

Shareholder’s Equity = 80,925,000

3. Put the values in the formula:

Long-term Debt to Equity Ratio = (Long-term debt) / (Shareholder’s Equity)

Long-term Debt to Equity Ratio = (41,194,000) / (80,925,000)

Long-term Debt to Equity Ratio = 0.509

multiply by 100 to express the value as a percentage

Long-term Debt to Equity Ratio = 50.9%

The Simply Investing Course comes with a Google Spreadsheet that will automatically calculate the debt values for you after you enter in the raw data.

Where can I see the debt numbers?

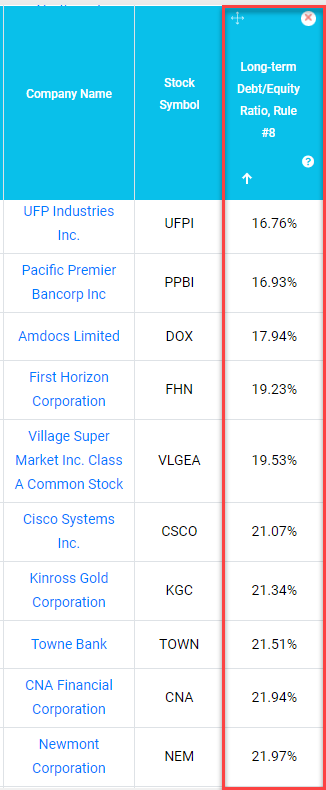

The Simply Investing Platform applies the debt formula to all US and Canadian stocks each day, making the debt numbers easily available for you:

I'm here to help

I can help you to start investing today, why re-invent the wheel when you can learn from my 20-years of being in the stock market. I've witnessed first hand the ups and downs of the market, and I know what it's like to start investing your hard earned money. I created the 12 Rule of Simply Investing to help you get started right away, so you don't have to wait on the sidelines any longer. The sooner you start investing the sooner you will be on your path to financial freedom.

0 comments

Leave a comment