Think you need lots of money to start investing?

You don't need thousands of dollars or millions of dollars to get started with investing. Just investing $10 a day could result in eventually earning over $31,000/year in passive income (dividends) and a stock portfolio worth over $1M.

You don't need thousands of dollars or millions of dollars to get started with investing. Just investing $10 a day could result in eventually earning over $31,000/year in passive income (dividends) and a stock portfolio worth over $1M.

Why do I need time and money?

In order to become a successful investor, you need time and money. The more money you have to invest the more dividends you can earn, and the more time you have the more you can reinvest and take advantage of compounding. Having both time and money is ideal, but when you are in your 20's you have time and very little money, in your 50s you have less time but more money. In this example let's take a look at a situation where you invest some money, but you have a 20-30 year time horizon.

How does this work?

Companies will pay you cash (called dividends) just to own their shares. The current annual dividend from IBM is $6.56/share (as of August 15, 2021). If you own 100 shares of IBM you would receive $656 each year for as long you own those shares, and as long as the company continues to pay the dividend. The good news is that over time most companies will increase their dividend payment to you. For example, Coca-Cola has had 57 years of consecutive dividend increases.

Is there another way to earn more?

Dividend increases from a company are great, because you automatically receive more money without have to invest more. But another way to accelerate your passive income is to re-invest those dividends into more dividend paying stocks. This powerful combination of dividend increases, and reinvesting dividends can be seen in the tables below, this is how you go from investing small amounts of money to building a million dollar stock portfolio.

How much can you earn?

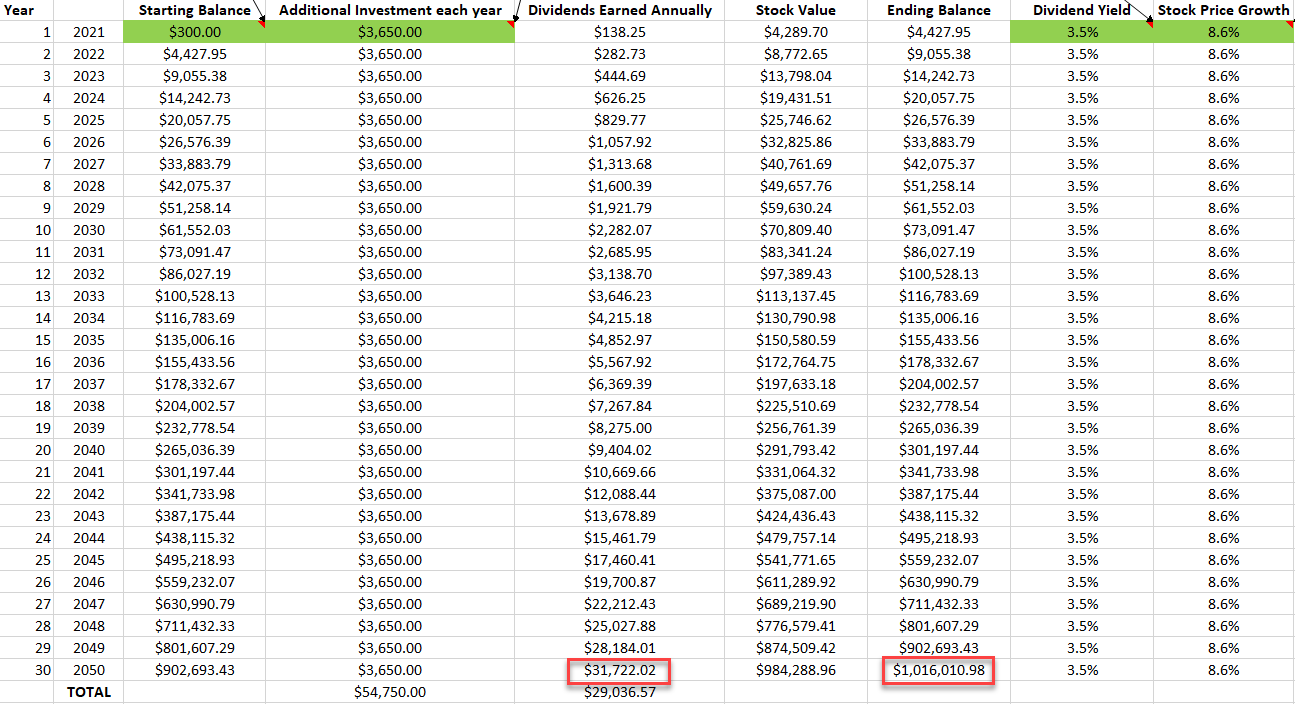

In the example below, let's assume you start with $300 invested in dividend stocks, and then you invest $10/day. You are investing for your financial future, you need to put money aside today in order to reap the benefits for life. As you can see in the table below, at year 30, you could be earning over $31,000/year in passive income, and your portfolio could be worth over $1M:

What if you can invest more?

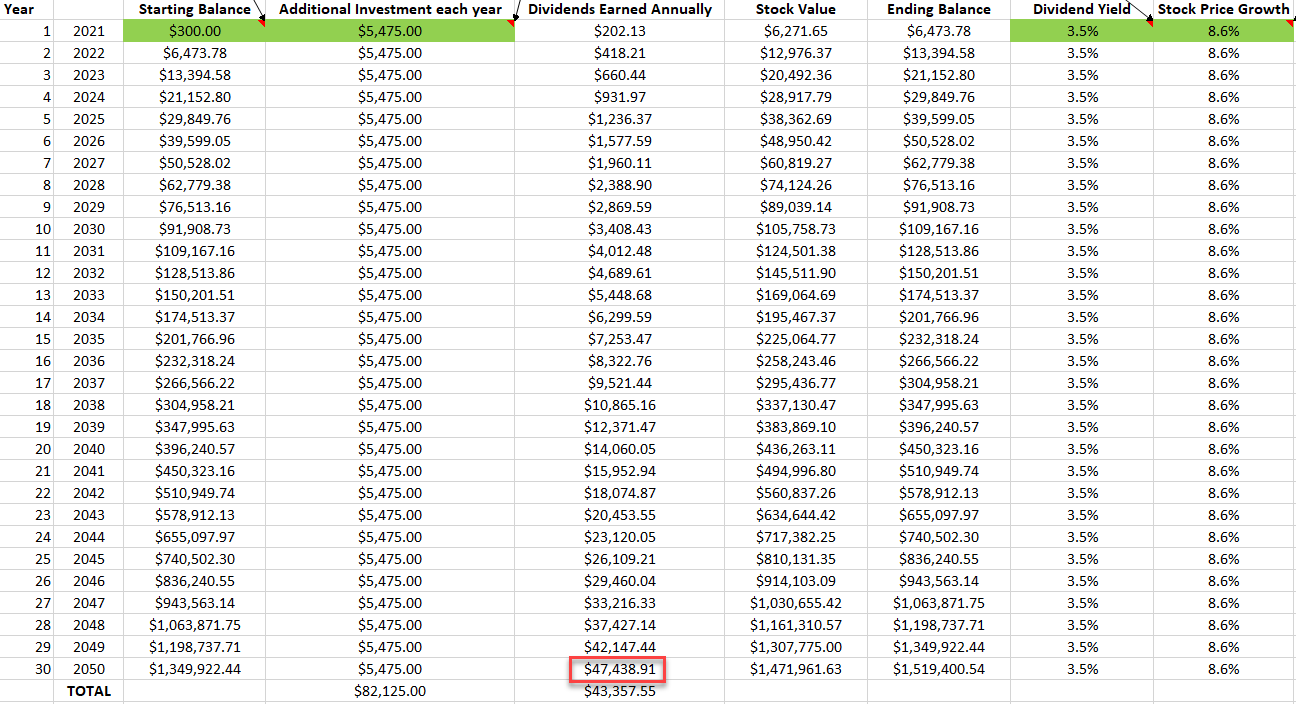

If you are able to invest $15/day, you can see that your passive income could grow to more than $47,000/yr:

What if I already have $30,000 in my 401k (or RRSP) and a day job?

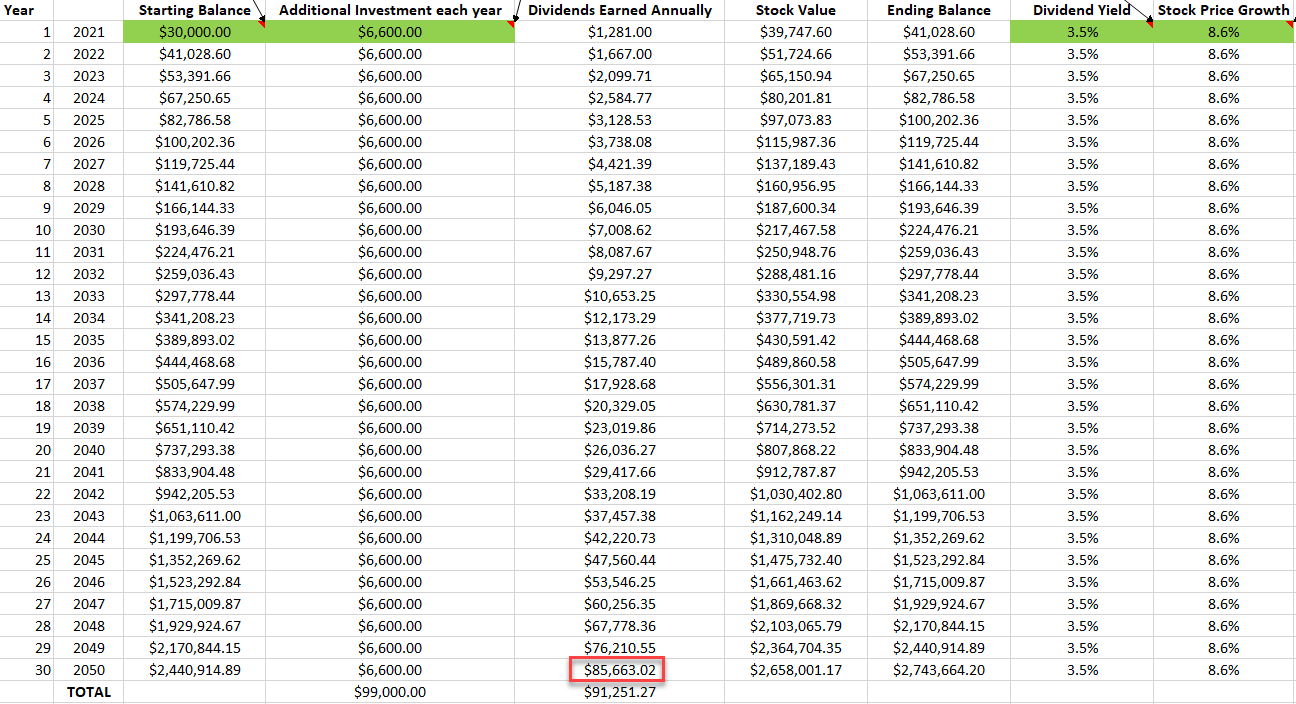

If you already have money saved up in a retirement account (which allows you to buy dividend stocks), and a day job that allows you to save $550 a month, your future passive income looks even better at over $85,000/year:

You can try out your own passive income projections

Everyone is different, some people can invest more, invest less, or have different time horizons. Or you may not agree with my assumptions of dividend yield, and stock price growth. Click here to download the spreadsheet (Excel file) I used to calculate these numbers, feel free to change the values in the green cells to try out your own passive income projections.

Can you do the same?

I designed the 12 Rules of Simply Investing to help you select quality dividend-paying stocks when they are priced low. If a company fails even one Rule you should move on to another company. These rules are designed to minimize your risk and maximize your gains for the long-term. These rules make investing easy and simple to implement. The goal is for you to build a resilient stock portfolio that will provide you with growing passive income each year, regardless of stock prices and the economy.

I'm here to help

I can help you to start investing today, why re-invent the wheel when you can learn from my 20-years of being in the stock market. I've witnessed first hand the ups and downs of the market, and I know what it's like to start investing your hard earned money. I created the 12 Rule of Simply Investing to help you get started right away, so you don't have to wait on the sidelines any longer. The sooner you start investing the sooner you will be on your path to financial freedom.

0 comments

Leave a comment