Are these your top 5 goals for investing?

When it comes to investing what are your goals? You might say "to make money!", which seems to be the number goal for most people. But what about risk and other factors? Let's take a look at the goals of the Simply Investing approach which I hope you will adopt as your own.

When it comes to investing what are your goals? You might say "to make money!", which seems to be the number goal for most people. But what about risk and other factors? Let's take a look at the goals of the Simply Investing approach which I hope you will adopt as your own.

Goals of Simply Investing

The goals at Simply Investing are simple:

- Help you to earn more

- Lower your risk

- Save on fees

- Help you generate income and growing income, regardless of market conditions

- Save you time

- Bonus goal (read below)

Help you earn more

At Simply Investing I teach you how to earn more without waiting around all day hoping for stock prices to rise. Hope will not cover your expenses or help you to pay for the things you want, only cash can do that. Therefore it is important to invest in companies that pay you cash just for holding their shares. The cash that companies pay you is called a "dividend". For example, if a company is paying $1 dividend per share and you own 100 shares, you will receive $1000 each year for as long as you own those shares and as long as the company continues to pay the $1 dividend. The dividends are deposited (monthly, or quarterly) directly into your trading account, you can spend the dividends if you wish or re-invest them. So how do you earn more than mutual funds, index funds, or ETFs? Easy, first you save on the fees (I talk more about this below), and secondly have a look at the typical dividend yields (the return on your investment while you own your shares):

| Investment Type |

Dividend Yield |

| Typical mutual fund |

1% |

| Typical index fund |

0.85% |

| Typical ETF |

0.5% |

| IBM stock |

4.89% |

| Pfizer stock |

4.30% |

| Kellogg stock |

3.66% |

| Coca-Cola stock | 3.18% |

| MetLife stock | 3.03% |

| Investment Type |

Annual Dividends |

| Typical mutual fund |

$200 |

| Typical index fund |

$170 |

| Typical ETF |

$100 |

| IBM stock |

$978 |

| Pfizer stock |

$860 |

| Kellogg stock |

$732 |

| Coca-Cola stock | $636 |

| MetLife stock | $606 |

- Do you understand the product or service offered by the company?

- Will people still be using this product or service in 20 years?

- Does the company have a low-cost durable (lasting) competitive advantage?

- Is the company recession proof?

- Has the company had consistent earnings growth? The EPS growth must be at least 8%

- Has the company had consistent dividend growth? The dividend growth must be at least 8%

- Does the company have a low payout ratio? Payout ratio must be 75% or less.

- Does the company have low debt? Debt must be 70% or less.

- Does the company have a good credit rating? Company must have a minimum S&P Credit Rating of “BBB+”.

- Does the company actively buy back its shares?

- Is the stock undervalued?

a. The P/E Ratio must be 25 or below.

b. Is the current dividend yield higher than the average dividend yield?

c. The P/B Ratio should be 3 or less. - Keep your emotions out of investing.

A reminder to keep emotion out of the selection process. Discipline and patience are the keys to successful investing.

All mutual funds, index funds and ETFs carry fees, these are referred to as the Management Expense Ratio (MER). The MER is used to pay for expenses incurred by the fund company for managing the fund. Even index funds cost money to manage, the fund company needs to cover the cost of staff, offices, IT systems, and marketing. The MER is charged regardless of how well or how poorly your funds perform, let's take a look at two examples (where the MER is 2%):

Example 1: Your funds do really well and gain 5%

Your actual return: 5% - 2% = 3%

Example 2: Your funds do poorly and loose -4%

Your actual return: -4% - 2% = -6%

As you can see from the above examples, in good times your gain is reduced by the fee. In bad times your loss is amplified by the fee.

In Canada the average MER is 2.2%, and the average amount held in a retirement account (RRSP similar to a 401k) is $100,000. Therefore the average Canadian over their lifetime could pay $642,212 in fees. How do you save on fees? Invest in individual stocks (they don't charge annual fees), but not just any stock, only those companies that pass the 12 Rules of Simply Investing.Help you generate income and growing income, regardless of market conditions

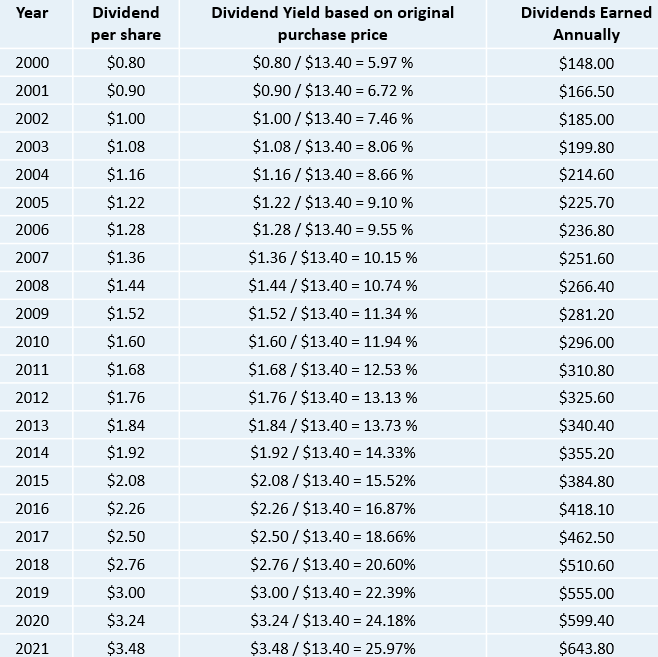

I already discussed generating income from dividends, but how do you make sure that your income will increase every year? You will invest in companies that have a history of increasing dividends each year, have a look at this table below:

| Company Name | Symbol | Consecutive Years of Dividend Increases | Dividends Paid Since |

| American States Water Company | AWR | 66 | 1931 |

| Northwest Natural Holding Co | NWN | 66 | 1951 |

| Dover Corporation | DOV | 65 | 1947 |

| Genuine Parts Company | GPC | 64 | 1948 |

| Emerson Electric | EMR | 63 | 1947 |

| Procter & Gamble | PG | 63 | 1890 |

| 3M | MMM | 62 | 1916 |

| Cincinnati Financial Corporation | CINF | 59 | 1954 |

| Johnson & Johnson | JNJ | 58 | 1944 |

| Coca-Cola | KO | 57 | 1893 |

| Lancaster Colony Corporation | LANC | 57 | 1963 |

| Lowe's | LOW | 57 | 1961 |

| Colgate-Palmolive | CL | 56 | 1895 |

| Hormel Foods Corporation | HRL | 55 | 1928 |

| California Water Service Group | CWT | 54 | 1931 |

| ABM Industries Incorporated | ABM | 53 | 1965 |

| SJW Group | SJW | 53 | 1932 |

| Stanley Black & Decker | SWK | 53 | 1876 |

| Stepan Company | SCL | 53 | 1967 |

| Target | TGT | 52 | 1965 |

| Black Hills Corporation | BKH | 50 | 1942 |

| Becton, Dickinson and Company | BDX | 48 | 1926 |

| W.W. Grainger | GWW | 48 | 1971 |

| Kimberly-Clark | KMB | 47 | 1935 |

| Pepsi | PEP | 47 | 1952 |

| PPG Industries | PPG | 47 | 1899 |

| RPM International Inc. | RPM | 47 | 1969 |

| Walmart | WMT | 47 | 1973 |

| Consolidated Edison | ED | 46 | 1885 |

| Illinois Tool Works Inc. | ITW | 46 | 1933 |

| S&P Global Inc. | SPGI | 46 | 1937 |

| Automatic Data Processing | ADP | 45 | 1974 |

| Archer-Daniels-Midland | ADM | 44 | 1927 |

| Walgreens Boots Alliance | WBA | 44 | 1972 |

| McDonald's | MCD | 43 | 1976 |

| Pentair plc | PNR | 43 | 1976 |

| Sherwin-Williams Company | SHW | 43 | 1979 |

| Clorox | CLX | 42 | 1968 |

| Medtronic | MDT | 42 | 1977 |

| Old Republic International Corp | ORI | 40 | 1942 |

| Sysco | SYY | 40 | 1970 |

| Franklin Resources | BEN | 39 | 1981 |

| Aflac | AFL | 38 | 1973 |

| Air Products and Chemicals | APD | 38 | 1954 |

| Atmos Energy Corporation | ATO | 38 | 1984 |

| Sonoco Products Company | SON | 38 | 1925 |

| Brown-Forman Corporation | BF.B | 37 | 1946 |

| Cintas | CTAS | 37 | 1984 |

| Exxon Mobil | XOM | 37 | 1882 |

| Cardinal Health | CAH | 34 | 1983 |

| Chevron | CVX | 34 | 1926 |

| Federal Realty Investment Trust | FRT | 34 | 1962 |

| McCormick | MKC | 34 | 1925 |

| Worthington Industries Inc. | WOR | 33 | 1968 |

| Nordson Corporation | NDSN | 31 | 1969 |

I know what you're thinking, "this stock investing is going to take too much time and effort". The reality is, you do not need to spend hours and hours each day watching your stocks. In my Simply Investing Course I give you a spreadsheet that you only need to fill out when you are ready to invest, some people do this once or twice a year. The spreadsheet makes it really easy to apply the 12 Rules of Simply Investing to any stock in the world. In the SI Report I do the work for you, I track over 250 stocks in the US and Canada and apply the 12 Rules of Simply Investing to each stock. On average my students spend about 10-15 minutes a month on building their money-generating stock portfolio.

A bonus goal of this system is that you never have to sell your shares (if you don't want to), and your portfolio will still generate growing income for you. With bonds, term deposits, mutual funds, index funds, ETFs, and non-dividend stocks you eventually have to eat into your capital in order to pay for the things you want (or just to cover your expenses). With our approach I have clients earning $10,000 to $50,000 per year in dividends annually and they don't have to sell a single share in order to receive their income.

I can help you to start investing today, why re-invent the wheel when you can learn from my 20-years of being in the stock market. I've witnessed first hand the ups and downs of the market, and I know what it's like to start investing your hard earned money. I created the 12 Rule of Simply Investing to help you get started right away, so you don't have to wait on the sidelines any longer. The sooner you start investing the sooner you will be on your path to financial freedom.

Did you enjoy reading this article? If so, I encourage you to sign up for my newsletter and have these articles delivered via email once a month … for free!

P.S: Read about how I saved Tracy over $1M in mutual fund fees, for more information you can also download the Case Study here.

0 comments

Leave a comment