Does fear and the complexity of stocks keep you from investing?

Does fear and the complexity of stocks keep you from investing? Let's take a look at both of these concerns to help you start earning more money quickly, safely, and reliably.

Does fear and the complexity of stocks keep you from investing? Let's take a look at both of these concerns to help you start earning more money quickly, safely, and reliably.

Is investing complicated?

Investing isn't complicated but the industry wants to make it appear complex so you'll have no choice but to hand over your hard earned money to them. When they (stock brokers, mutual fund, index fund, and ETF companies) invest on your behalf they make money from fees. In fact they make money whether you make money or not, the fees are subtracted first from your account before you see a penny of gains. Investing is so simple a 9 year old can do it, in fact here's a picture of my daughter buying her first stock when she was 9 years old:

My daughter completed my Simply Investing Course when she was nine, and she understood the importance of investing in quality companies that provide her with free money (dividends).

How do you make investing simple?

First I eliminate any financial jargon, then I start with the basics: What is a stock? What is a dividend? From there I use simple building blocks to relay to my students the information they need to invest successfully. The final step is to build your confidence, and this comes from making your first investment, and it can be a very small investment, then watch the dividends come in and you'll build your confidence to continue investing.

Here is a message a student left recently on my forum:

When it comes to investing, it's normal to be afraid of making mistakes: What if I invest in the wrong company? What if the market crashes and I lose my hard earned money? Your fear comes from a lack of knowledge, not knowing what to invest in, when to invest, and how to invest. With the Simply Investing Course I can help you eliminate your fear of investing by answering your top 3 questions:

- How do I start investing?

- What do I invest in?

- How do I minimize my risk?

With investing knowledge your fear will disappear and it'll be replaced with confidence. I've helped hundreds of individuals like yourself to overcome your fear of investing and learn how to start building for yourself an income generating portfolio.

In order to make money you need: time and money

Time to take advantage of dividend increases. The younger you start investing the better off you will be. It takes many years for dividend increases to finally start yielding double-digit returns. With enough time on your side you will be able to weather any economic downturns.

You need money to make money. Here's a look at the returns based on how much you invest, for a single stock yielding 5%:

- $1000 invested after one year will yield $50 in dividends

- $10000 invested after one year will yield $500 in dividends

The more money you invest the more money you can make.

Having both time and money will help you achieve financial success sooner.

To answer your question then, how much money can I make? This will depend on how much money you are able to invest, and how long you are able to stay invested.

You can download our Excel Spreadsheet to estimate how much money you can make. You can then update the values in the green cells to try out different scenarios.

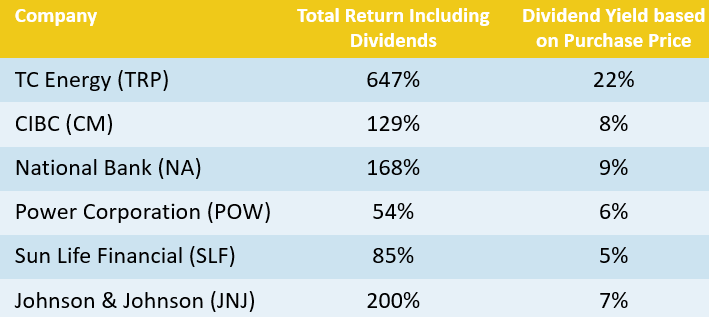

Here are some sample rates of returns from stocks I currently own:

I'm here to help

I can help you to start investing today, why re-invent the wheel when you can learn from my 20-years of being in the stock market. I've witnessed first hand the ups and downs of the market, and I know what it's like to start investing your hard earned money. I created the 12 Rule of Simply Investing to help you get started right away, so you don't have to wait on the sidelines any longer.

Did you enjoy reading this article? If so, I encourage you to sign up for my newsletter and have these articles delivered via email once a month … for free!

0 comments

Leave a comment