Introducing

The 12 Rules of Simply Investing & the SI Criteria

Save time, earn more, and reduce your risk by learning how to invest in the best dividend stocks

What are the 12 Rules of Simply Investing?

The 12 Rules of Simply Investing are designed to help you select dividend paying stocks that are of the highest quality and are also priced low (undervalued). In the long-term these rules are designed to minimize your risk, maximize your gains, and save you time. These rules make investing easy and simple to implement. The goal is for you to build a resilient stock portfolio that will provide you with growing passive income, regardless of stock prices and the economy.

Ideally a company should pass all the 12 Rules of Simply Investing before you invest it. The Simply Investing Report & Analysis Platform automatically shows you which stocks pass which of the 12 Rules (see SI Criteria below). The Simply Investing Course shows you step-by-step how to apply the 12 Rules of Simply Investing to any stock.

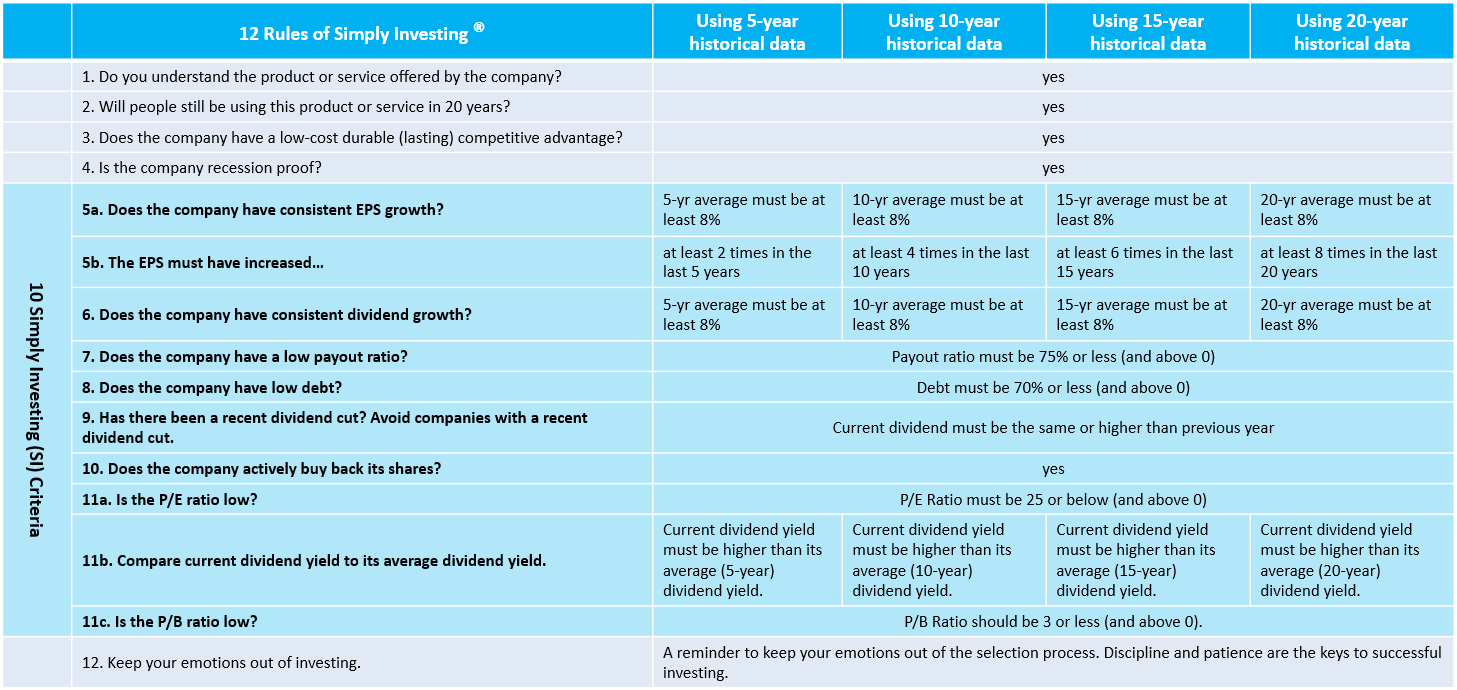

12 Rules of Simply Investing & SI Criteria

What are the Simply Investing (SI) Criteria?

The SI Criteria is a subset of the 12 Rules of Simply Investing, the following rules make up the SI Criteria: Rules 5a, 5b, 5c, 6, 7, 8, 9, 10, 11a, 11b, 11c.

The 12 Rules of Simply Investing are shown above, and the SI Criteria is shown in bold.

The Simply Investing Report & Analysis Platform automatically applies each day the SI Criteria to over 6000 common stocks in the US and Canada.

How do I use the SI Criteria to select stocks?

Rules #5 to #11 are quantitative, a stock that passes all the quantitative ten criteria listed in bold achieves a maximum grade of 10 out of 10. Therefore, always begin by looking at stocks that achieve a 10 out of 10 in the SI Criteria.

The Simply Investing Report & Analysis Platform automatically applies each day the SI Criteria to over 6000 common stocks in the US and Canada. However, you are still responsible for applying Rules #1 to #4 and #12.

In the Simply Investing Course, the provided Google Sheet automatically applies the 10 SI Criteria rules after you've entered in the financial data for stocks you are researching.

What are the 4 types of SI Criteria?

There are 4 types of SI Criteria based on the historical data range used to evaluate the criteria: 5-years, 10-years, 15-years, 20-years

What is the recommended SI Criteria (5, 10, 15, or 20-years) to use?

The recommendation is to use the 20-year averages.

Why are you recommending 20-year averages and not 5, 10, or 15 years?

The 10-year time period is fine but not ideal, the average market cycle is about 5-6 years. When I evaluate a stock, I need to make sure the company has gone thru at least 3 market cycles. 3 market cycles provide us with a sufficient pattern of high-low yields. During those cycles a company will experience: market downturns, industry troubles, tax/legislative changes. A company will need time to adjust to those changes, a 20-year time period ensures that a company that can survive adversity for that long also has the capacity to survive future adversity.

The 20-year time frame is considered ideal. We are long-term investors, history has a way of repeating itself, we cannot predict the future but we can analyze past results and make good decisions today. A company that can be profitable and increase its dividend for 20 years has a high probability of continued success over the next few decades. Our goal is to minimize risk, and one way to do that is to use history as our guide.

Then why bother to show the 5, 10, or 15-year averages if you're only recommending to use the 20-year averages?

As I mentioned above I recommend using the 20-year averages when applying the SI Criteria to determine a buy or sell decision. However, there are some investors that prefer to use 5, 10, or 15-year averages, because they believe that the 20-year time frame is too large. They believe that the stocks markets and the economy of today are very different from 20 years ago, therefore they only want to analyze historical data that is less than 20 years old. I do not agree with only looking at short-term data, I recommend using the 20 year averages and you can see my reason why (see previous question above), however the goal of the SI Platform is to provide data from all different time periods, which is why we include the 5, 10, 15 year values, and we also provide data on stocks that don't pay any dividends.

Where can I learn more about the 12 Rules and can I apply them to international stocks?

Yes, you can apply these 12 Rules to stocks outside of the US and Canada. The Simply Investing Course explains the 12 Rules in greater detail, using real-life examples, and provides you with your own Google Sheet to apply the Rules to international stocks. The Simply Investing Course has been used successfully in over 30 countries since 2007.

No time to take my online course? Then the Simply Investing Report and Analysis Platform is for you. The SI Platform automatically applies each day the SI Criteria to over 6000 common stocks in the US and Canada.

The 12 Rules of Simply Investing are time tested and designed to keep you from making mistakes. Investing really can be this simple!

How To Avoid The Top 5 Investing Mistakes

Uncover the five most significant (and easy to make) mistakes when investing.

Download this free guide and you never have to worry about making these costly mistakes again.

Any Questions? Get in touch.