Introducing

The Financial Freedom Investing Course

Helping you save time, earn more, reduce your risk by investing confidently in the best dividend stocks

Simply Investing Course

1,000+ students

in

30+ countries

INVESTING MADE SIMPLE

INVESTING MADE SIMPLE

Learn how to build your own stream of passive income by investing in the best dividend stocks

Learn how to build your own stream of passive income by investing in the best dividend stocks

Our online investing course will teach you how to build a resilient stock portfolio that'll provide you with growing passive income each year, regardless of what happens in the stock market, and without having to sell your shares.

Save Time

We give you the knowledge and tools to save time. No need to spend hours researching what stocks to invest in and which stocks to avoid.

Earn More

Easily build your own portfolio, save thousands of dollars in fees, and increasing dividends help you earn more, all without having to sell your shares.

“Kanwal has a fresh, new way of looking at investing. Wish I knew all this years ago! This approach is simple, profitable, easy to understand, and easy to implement."

Hi, I'm Kanwal Sarai, and I teach everyday folks like you the step-by-step actions you need to build a resilient stock portfolio that provides you with growing passive income each year, regardless of what happens in the stock market.

In this investing course, I take the guesswork out of trying to determine what to invest in and what to avoid. The result? You will be able to EARN MORE, save TIME, and reduce your risk when it comes to investing.

Right now, you might be thinking:

"Isn't investing risky?"

"Is it going to be time consuming?"

"Won't it be complicated?"

I've heard these questions before, and I've even asked them myself before I started my journey into investing.

More than 20 years of being a dividend investor has taught me that investing:

- isn't complicated

- isn't time consuming

- and isn't risky

...if you have the KNOWLEDGE of how to invest and what to invest in. Why re-invent the wheel? Avoid trial and error, and learn from my two decades of experience as a successful investor. In this course I give you the investing knowledge & tools you need to succeed.

Does this mean that you’ll achieve financial success overnight?

Of course not. This approach is a long-term strategy to generate wealth in a consistent and low risk manner. This isn’t day trading or jumping on to the next investing trend of the month. It also depends on how you pace through the lessons, and then apply the strategies to your own investments. I truly believe if you are eager and committed about putting into action what you’ll learn, you can achieve financial success sooner than later.

This course will teach you how to achieve your financial goals, and here’s why:

- It contains over 20 years of my experience as a dividend investor

- You’ll learn from my mistakes, and my successes

- The training material is clear, concise, and without any fluff or technical jargon. It’s so easy my 9 year old completed this course!

- I’ll show you how to save hundreds of thousands of dollars in fees you may currently be paying with your mutual funds, index funds or ETFs

- At the end of the course, I’ll set you up for success with a clear action plan, and show you how to continue to earn more, save your time, and reduce your risk in the years ahead.

By the End of This Course,

You'll Have Mastered:

Finding Quality Stocks

How to quickly discover high quality stocks to invest in.

Finding Undervalued Stocks

How to quickly discover stocks that are priced low

Building a Resilient Portfolio

How to build an income generating portfolio regardless of what happens in the economy

Growing Income

How to build a portfolio that generates growing income each year

Investing with Confidence

How to invest responsibly, minimize your risk, and invest with the new knowledge you've gained

Investing with Discipline

How to remain calm even during market downturns, and continue on your path to financial freedom

The Financial Freedom Investing Course

+

Simply Investing Tools

Give you everything you need to become financially successful!

Not only have clients saved millions of dollars in fund fees, some of them are earning 20, 40, and over $50,000 a year in passive income from dividends each year.

More importantly their passive dividend income continues to grow each year, regardless of what happens in the stock market.

"Kanwal's course in dividend value investing was easy to understand. I'm glad I took it. It is the only way I will buy stocks now. It is satisfying to watch my investments grow."

HYATT SAIKIN

"With Kanwal's help I was able to save over $1.3M in fees I would have paid with my original investments. Using the Simply Investing approach I was also able to grow my investment income by 74% in one year, without adding more money to my account. I can now invest with confidence!"

TRACY D.

Your Financial Freedom Investing Course includes:

Course Access:

Lifetime

Video Lessons:

31

Forum Access:

Lifetime

You Will Get:

Financial Freedom Investing Course

Lifetime access to video lessons, Google Sheets, Reference Guide, Bonus Videos

Access to the SI Platform

Over 6000 stocks analyzed

Top ranked stocks listed daily

Includes 1 or 2 or 6-month access

Access to the Forum

Ask questions, get answers

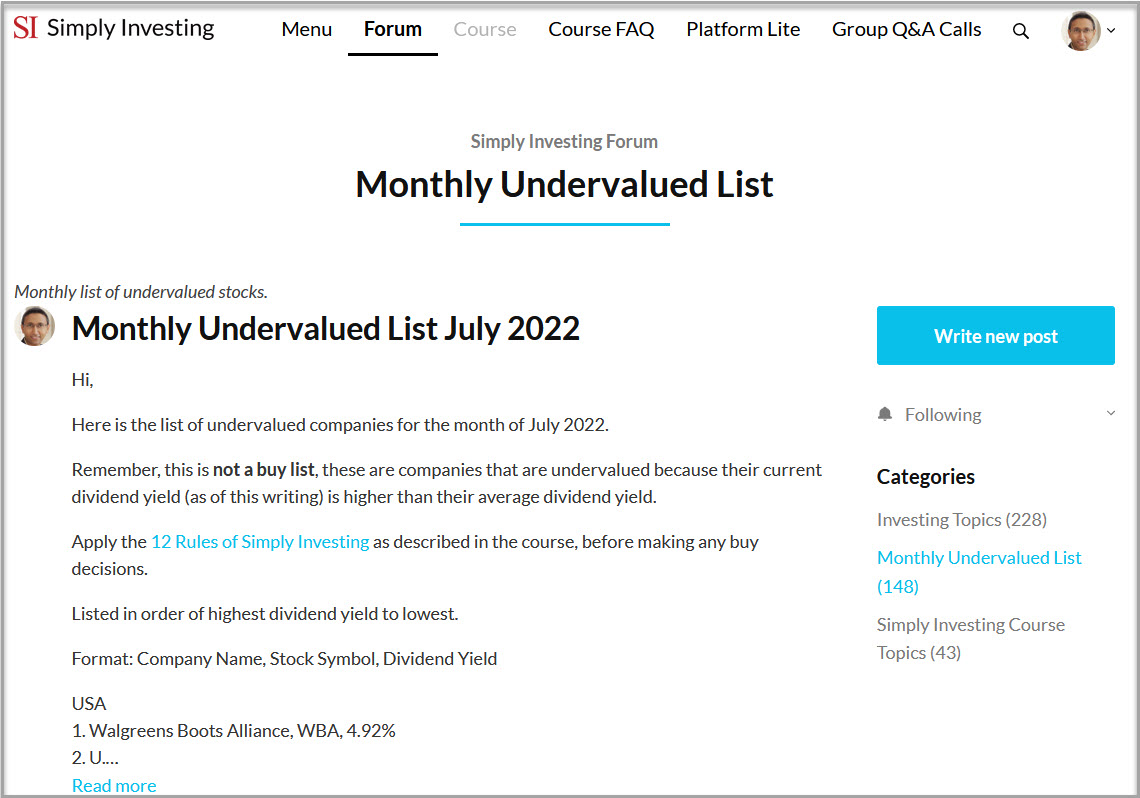

Monthly list of undervalued stocks

Only available in Value or Premium Packages

Financial Freedom Investing Course

What's Inside

Module 1- Investing Basics

We're going to hit the ground running and set you up with the best possible foundations to start investing.

- An overview shows you what you will learn in this course

- My story of how I got started so you can avoid my mistakes, and learn from my experience of more than 20 years

- We will also debunk the 3 most common investing myths that often hold people back

Module 2 - 12 Rules of Simply Investing

We're going to break down the 12 Rules of Simply Investing, and include real-life examples.

- These rules will be the building blocks for your investing strategy going forward, they will help you discover quality stocks that are also priced low (undervalued)

- The 12 Rules are designed to maximize your gains and minimize your risk

- Learn which stocks to invest in and which ones to avoid

- Only after you understand and can apply these 12 Rules, can you start investing in quality dividend stocks

Module 3 - Applying the 12 Rules

You guessed it, we're going to start applying the 12 Rules of Simply Investing.

- I’ll be personally guiding you through real-life examples, you are going to know exactly how to select quality stocks and avoid the lousy ones.

- Use our simple checklist to quickly discover quality stocks

- I give you a complete DIY system that you can use to evaluate any stock in any market worldwide

Module 4 - Using the Simply Investing Platform

I’ll introduce you to the Simply Investing Platform. I’ve spent the last 2 years developing this tool from the ground up. It's the tool that I wish existed when I started investing more than 20 years ago.

- This platform will allow you to quickly discover quality dividend stocks that are also priced low (undervalued)

- Everything you learned in Module 3, the Platform automatically applies the Rules to over 6000 stocks daily and shows you which stocks to consider for investing and which ones to avoid

- I take you step-by-step on how you would use the Platform to select quality stocks to invest in

Module 5 - Placing Your First Stock Order

Now that you have a list of quality stocks to invest in. How do you actually go about and place your first stock order?

- You will learn what is a trading account, and what are the different types of accounts available

- You will see which trading accounts are beneficial in reducing your taxes when it comes to investing

- I’ll show you step-by-step how to place your first stock order

Module 6 - Building & Tracking Your Portfolio

Having placed your first stock order, the next step is to start building a stock portfolio.

- In this module I’ll show you how to build a resilient stock portfolio regardless of what happens in the economy

- You will learn about the importance of diversification

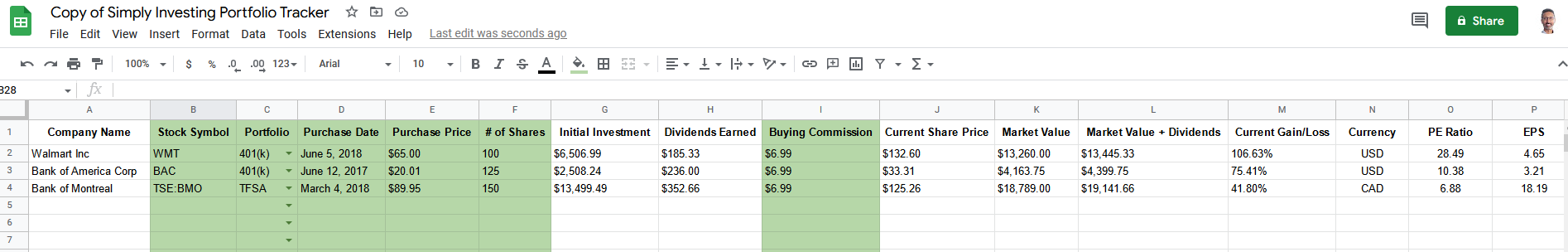

- It’s also important to track your portfolio, and in this module I’ll take you step-by-step through the process of tracking your portfolio using the Simply Investing Portfolio Tracker

Module 7 - When to Sell

It’s important to know which stocks to buy, and we’ve covered that in the first 6 modules. But it’s just as important to know when to sell a stock.

- Learn why you should not automatically sell your stocks when they become overvalued

- In this module I provide you with guidelines to determine if and when you should sell your stocks

- I also take you step-by-step with real life examples to determine which stocks to sell

Module 8 - Reduce Your Fees & Risk

Investing in quality dividend stocks is important, they provide you with passive income. But it’s also important to reduce or eliminate the annual fees that you currently pay for your mutual funds, index funds, or ETFs.

- You will learn what is a Mutual Fund, Index Fund, and ETF

- You will see the disadvantages of investing in funds

- In this module I show you real-life examples, that even a seemingly small fee of 0.5% can have drastic negative effects on your portfolio, and financial success

- You'll learn how to reduce or eliminate the fees you are currently paying for your funds

- I will show you the 7 types of risks you may face as an investor

- You will learn how to avoid or minimize these 7 types of investing risks

Module 9 - Your Action Plan

Having completed the course, I provide you with your action plan to get started immediately, and put you on the path to financial freedom.

- In this module we will revisit the 3 investing myths from Module 1

- You will learn that investing does not have to be complicated, time consuming, or risky

- I will provide you with your action plan to get started with dividend investing

Module 10 - Answering Your Questions

I answer your most frequently asked questions.

- Learn what to do if your stock drops in price

- You will learn why dividend reinvestment plans are not good for you

- Discover how long it takes for a stock to go from undervalue to overvalue

- You'll learn if the 12 Rules of Simply Investing are flexible or not

In addition you receive the following...

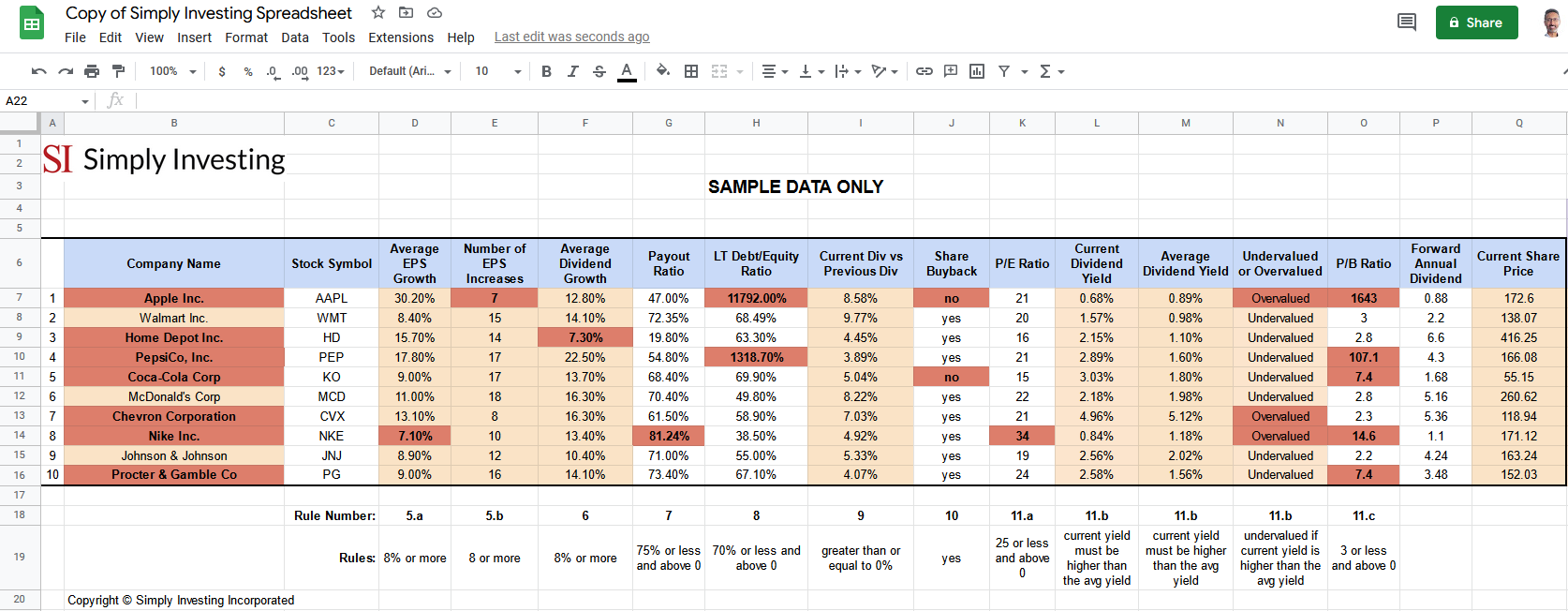

SI Google Sheet

The Simply Investing Spreadsheet is a Google Sheet designed to help you quickly research and discover stocks to invest in or avoid. You will use the spreadsheet to apply the 12 rules of Simply Investing to any stock in the world.

Lifetime Access to SI Platform-Lite

Lifetime access to our web application the Simply Investing Platform-Lite. The Platform-Lite gives you access to financial data on over 6000 stocks going back 22 years. You will learn how to fill out the Simply Investing Spreadsheet using the Platform-Lite to collect the data you need to find quality dividend stocks.

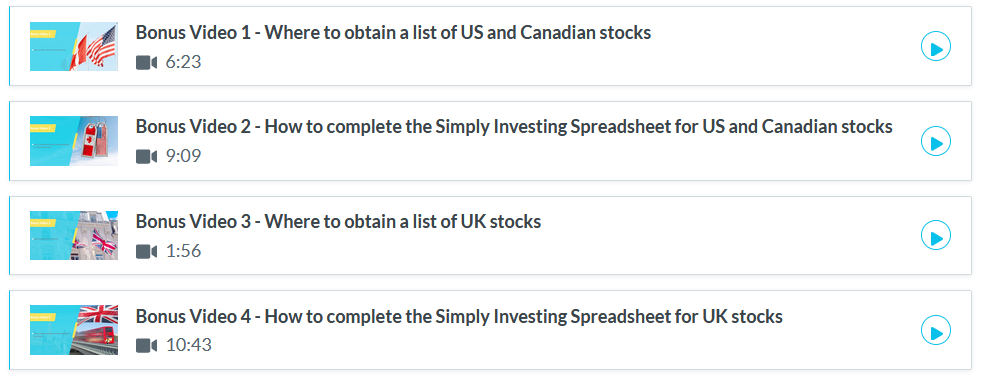

4 Bonus Videos

4 Bonus videos take you step-by-step through the process of using the Platform-Lite to fill out your Simply Investing Spreadsheet.

Access to SI Platform-Full (1, 2 or 6 months)

Free limited time access to our web application (Basic Package includes 1 month free, Value Package includes 2 months free, Premium Bundle includes 6 months free), the full Simply Investing Platform. The Platform automatically applies the 10 SI Criteria to over 6000 stocks each day, and provides you with a list of quality stocks to consider for investing. The Platform does all the work for you, so if you prefer you can skip the spreadsheet analysis (using the SI Google Sheet).

SI Portfolio Tracker

The Simply Investing Portfolio Tracker is designed to help you keep track of your Portfolio. The tracker shows your stock performance, daily stock data, and your dividend income all in one place.

Value Package: 2 Months Access to SI Platform-Full

2 months free access to our web application, the full Simply Investing Platform. The Platform automatically applies the 10 SI Criteria to over 6000 stocks each day, and provides you with a list of quality stocks to consider for investing. The Platform does all the work for you, so if you prefer you can skip the spreadsheet analysis.

Value Package: Lifetime Access to SI Forum

Lifetime access to the Simply Investing Forum, this is an online forum exclusive to Simply Investing Course clients, it is a great place to ask questions and discuss dividend investing. Forum access is only available in the Value or Premium Packages.

Value Package: 10% Discount on future purchases

10% discount on future purchases, you will receive a coupon code that you can use for any future Simply Investing purchase, that includes a subscription to the Simply Investing Platform, or personal assessment calls. This is only available in the Value or Premium Packages.

What happens after you enroll?

Here’s what happens after you sign up.

You'll get an email with instructions to access everything listed below, you get instant access to:

- the Financial Freedom Simply Investing Course, the Forum (Value Package only), and the Platform

- more than 31 online video lessons that you can access 24/7 from your account

OUR GUARANTEE

Earn more - Save your time - Reduce your risk

If you are not satisfied with the Simply Investing Course, please contact us within 30 days of your purchase with your reason, and we will happily provide you with a refund minus the $45 cost for the Simply Investing Platform access.

Do You Have Any Questions?

Do You Have Any Questions?

Yes. This course is for beginners and it will teach you step-by-step on how to get started with investing.

Even if you have experience investing in stocks. index funds or ETFs, this course will provide you with the knowledge and confidence to select quality dividend stocks when they are priced low (undervalued). You will learn how to build a resilient stock portfolio that will provide you with growing passive income each year, regardless of what happens in the economy.

The course is self-paced and entirely online, you can take your time, and repeat or pause any video lesson.

You also have unlimited life-time access to the course.

Here is a list of the video lessons including the duration:

Lesson 1 (4 mins 55 seconds)

Lesson 2 (3:30)

Lesson 3 (1:42)

Lesson 4 (6:39)

Lesson 5 (6:38)

Lesson 6 (20:24)

Lesson 7 (4:54)

Lesson 8 (14:28)

Lesson 9 (1:11)

Lesson 10 (5:28)

Lesson 11 (5:58)

Lesson 12 (3:05)

Lesson 13 (7:00)

Lesson 14 (3:19)

Lesson 15 (4:02)

Lesson 16 (2:51)

Lesson 17 (8:03)

Lesson 18 (3:49)

Lesson 19 (8:29)

Lesson 20 (2:55)

Lesson 21 (3:22)

Lesson 22 (10:59)

Lesson 23 (6:35)

Lesson 24 (9:08)

Lesson 25 (1:40)

Lesson 26 (3:06)

Lesson 27 (5:37)

Bonus Video 1 (6:23)

Bonus Video 2 (9:09)

Bonus Video 3 (1:56)

Bonus Video 4 (10:43)

Total Duration: 3 hours 8 mins

In order to make money you need: time in the market and money

Time to take advantage of dividend increases. The younger you start investing the better off you will be. It takes many years for dividend increases to finally start yielding double-digit returns. With enough time on your side you will be able to weather any economic downturns.

You need money to make money. Here's a look at the returns based on how much you invest, for a single stock yielding 5%:

- $1000 invested after one year will yield $50 in dividends

- $10000 invested after one year will yield $500 in dividends

The more money you invest the more money you can make.

Having both time and money will help you achieve financial success sooner.

To answer your question then, how much money can I make? This will depend on how much money you are able to invest, and how long you are able to stay invested.

You can download our Excel Spreadsheet to estimate how much money you can make. You can then update the values in the green cells to try out different scenarios.

There is no fixed schedule to take the Simply Investing Course, you can start the course immediately after you enroll. The course is self-paced and entirely online, plus you get lifetime access to the course.

You can also access the SI Forum, and SI Platform immediately after you enroll.

There is no ongoing yearly cost for the course. The one-time fee gives you the following:

- lifetime access to the investing Course

- lifetime access to the SI Platform-Lite

- lifetime access to the SI Forum

- lifetime access to the SI Portfolio Tracker, and SI Spreadsheet

- 1-month access to the full Simply Investing Platform (Basic Package only)

- 2-months access to the full Simply Investing Platform (Value Package only)

With all of the above you will have the knowledge and tools to continue to invest without having to pay any yearly fees to Simply Investing.

However (and this is completely optional) if you'd like to continue to access the full SI Platform after you free trial, the cost starts at $25/month or $270/year.

In the Course I teach you how to apply the 12 Rules of Simply Investing to any stock, this allows you to select quality stocks that are also priced low (undervalued).

The full SI Platform automatically applies the rules to over 6000 stocks each day, and gives you a list of quality stocks that are also undervalued.

Therefore, you don't need the SI Platform in order to invest, it just speeds up the research process for you.

You have life-time access to the following:

- Simply Investing Course (video lessons, reference guide, spreadsheets)

- Simply Investing Platform-Lite

- Simply Investing Forum

The following items are time limited:

- 1 month free access to the full Simply Investing Platform (Basic Package only)

- 2 months free access to the full Simply Investing Platform (Value Package only)

Yes, the Financial Freedom Investing Course is the same, and is included in all 3 packages (Basic, Value, Premium).

The Simply Investing Course:

- Consists of 27 video lessons, bonus videos, a guide book (PDF), portfolio tracker, and Google spreadsheet

- The Google Spreadsheet automatically applies the 10 SI Criteria rules to each stock, after you've filled in the financial data

- Teaches you "The 12 Rules of Simply Investing" and how to find quality dividend paying stocks that are undervalued (priced low)

- Can be purchased for a one-time payment, and comes with unlimited access to the course, the SI Platform-Lite, and any future updates

- Value packages also come with membership to the Simply Investing Forum

The Simply Investing Platform-Full:

- The SI Platform is a web application that tracks over 6000 common stocks in the US and Canada

- The SI Platform lists stocks that are undervalued (priced low) and the ones that are overvalued (priced high)

- Applies the SI Criteria to each stock every day, and applies a grade out of 10 to each stock

- Access to all features including the 3 basic features in the SI Platform-Lite

- Provides you with over 120 metrics for each stock

- Can be purchased by a monthly or annual subscription

The Simply Investing Platform-Lite:

- As part of your course purchase, you have access to the following 3 features:

- Basic Search, which gives you access to financial data only on over 6000 common stocks in the US and Canada (including up to 21 years of historical data)

- Access to the DOW 30 list of companies

- Access to the TSX 60 list of companies

- SI Platform-Lite does not apply the SI Criteria, you need to do this yourself by inputting the financial data into the Google Spreadsheet (that comes with the SI Course)

- Access to the SI Platform-Lite cannot be purchased separately, it only comes with the SI Course purchase

In conclusion, the Platform-Lite does not do the research for you, it only provides the financial data for you to perform the analysis yourself. However, the Platform-Full does the work for you, it performs the analysis and gives you the result for over 6000 stocks daily.

The Simply Investing Report & Analysis Platform feature list:

1. tracks over 6000 common stocks that trade on the NYSE, NASDAQ, and TSX

2. automatically updates stock prices and financial data once a day (end-of-day)

3. applies the SI Criteria to all stocks once a day

4. over 120 metrics are available for each stock

5. shows you which stocks to consider (Top Ranked) and which ones to avoid (overvalued)

6. updates the following pre-built 8 stock tables daily, and makes them easy to view:

- Top Ranked Stocks, stocks that achieve a 10 out of 10 in the SI Criteria

- Runners-Up Stocks, stocks that achieve a 9 out of 10 in the SI Criteria

- Dividend Stocks Undervalued, lists all dividend stocks that are undervalued

- Dividend Stocks Overvalued, lists all dividend stocks that are overvalued

- Dividend Stocks Deep Valued, lists all dividend stocks that are deeply undervalued

- Non-Dividend Stocks Undervalued, lists all non-dividend stocks that are undervalued

- Non-Dividend Stocks Overvalued, lists all non-dividend stocks that are overvalued

- Non-Dividend Stocks Deep Valued, lists all non-dividend stocks that are deeply undervalued

7. allows you to track your portfolio, view your diversification, and estimate your annual income

8. allows you to build your own stock watch list

9. allows you to create your own email stock alerts

10. allows you to receive daily, weekly, or monthly stock tables in your email inbox

11. includes basic and advanced search capabilities

12. provides a list of the DOW 30 and TSX 60 stocks (updated daily)

13. allows you to generate your stock graphs (dividends per share, low price, high price, average price, EPS)

14. allows you to compare stocks side-by-side

15. shows you immediately which stock fails which of the 10 SI Criteria, the values are in bold, and the cells are highlighted

16. each table shows you the SI Criteria definition

17. provides you with more than 20 years of historical stock data

18. allows you to customize your stock tables: you can add/hide/move columns, you can sort columns, perform advance searches

19. includes guidelines for building your stock portfolio

20. includes 18 video tutorials to demonstrate the features on the Platform

21. includes a comprehensive FAQ section

22. includes this data and more for each stock:

- dividends paid since

- consecutive years of dividend increases

- consecutive years of EPS increases

- 5-year, 10-year, 15-year, 20-year average dividend growth

- 5-year, 10-year, 15-year, 20-year average EPS growth

- Graham Price

- PEG Ratio

- Quick Ratio

- ROA, ROC, ROE

- P/CF, P/FCF, P/S

- undervalued (priced low), or overvalued (priced high) status for both dividend and non-dividend stocks

23. zero advertising

We certainly want you to be satisfied with your purchase but we also want you to give your best effort to apply all of the strategies in the course.

We do offer a 30-day refund period for purchases. If the course is not for you, simply email us with your reason, and we'll issue you a complete refund minus $45 to cover the SI Platform access fee.

In the course I use examples of Canadian and U.S. stocks, but you can certainly apply the same concepts to stocks anywhere in the world.

I have customers from Azerbaijan, Sweden, U.S., Thailand, Tanzania, Switzerland, South Africa, Singapore, New Zealand, Romania, Qatar, Norway, Malaysia, India, Hungary, UK, France, Czech Republic, Brunei, Australia, and Canada who have completed the course and successfully applied the dividend value investing principles to stocks trading in their own country.

Yes. This course includes the following 3 additional resources to help you apply the 12 Rules of Simply Investing to UK stocks:

- The Simply Investing Spreadsheet designed specifically for evaluating UK stocks

- Bonus Video 3 shows you how to obtain a list of UK stocks to begin populating your spreadsheet

- Bonus Video 4 which takes you step-by-step through the process of collecting financial data for UK stocks

Short answer: No

Long answer: The Simply Investing Approach is a long-term strategy for investing in dividend stocks. In the short-term stock prices and stock markets fluctuate. However, in the long-term (5-10 years or more) the stock market can provide great returns.

I teach in the Simply Investing Course that any money you need in less than 5 years should not be invested in stocks (that includes mutual funds, index funds, and ETFs). Imagine your are saving to buy a house/car/vacation and you invest $20,000 in the stock market, what happens if the value of the stocks drops to $14,000 in 2 years, and you need the money in 2 years? This is not a great position to be in, you should not be forced to sell your investment at a loss because you need the money.

You should have a long-term horizon so that you can ride out any market downturns. Therefore it's best to stay invested for at least 5 to 10 years or more. The longer your time horizon, the more you can take advantage of compounding, and growing dividends.

Quick story: In 2001 I invested $2479 in 185 shares in TC Energy for $13.10 each, the dividend at the time was $0.80/share. Today the dividend is $3.48/share, since then I have received over $7300 in dividends alone from this company. My risk with respect to my investment in TC Energy is 0% today. My dividend yield based on the purchase price is now 26%. All this is only possible if you stay invested for the long-term.

I limited amount of access to the SI Platform-Full is included in your SI Course package:

- Basic Package comes with 1 month access

- Value Package comes with 2 months access

- Premium Bundle comes with 6 months access

If you wish to keep your access to the SI Platform, after your free subscription ends, you can purchase a separate subscription here.

WITH THE FINANCIAL FREEDOM INVESTING COURSE

YOU CAN:

Earn more

Reduce your risk

Save your time

Invest in quality dividend stocks

Quickly start earning passive income today

The Simply Investing Course is for you if you're tired of losing money and wasting time

If you’d like to obtain financial freedom sooner than later, sign up for the Simply Investing Course today.

One of our clients Tracy saved more than $1.3 million dollars in mutual fund fees alone, and grew her passive income by 74% (in a single year) after implementing our Simply Investing approach.

Watch Lesson 1 Right Now

This course offers the fastest and easiest way to learn how to invest your money through dividend investing.

Build your own stream of growing income so you can:

- Set yourself on the road to financial freedom today

- Learn at your own pace – at home or on the go

- Get simple step-by-step instructions to ensure the best and safest investing

- Focus on stable dividend paying stocks

TESTIMONIALS

TESTIMONIALS

What they thought about the course

What they thought about the course

This Investing Course is a Must Have if...

- you are tired of wasting your money on fund fees

- you want to grow your net worth

- you want to build a reliable stream of growing passive income, regardless of what happens in the economy

- you want to take charge of your investments

- you want to earn more, save your time, and reduce your risk

Your Instructor Kanwal Sarai

As a dividend value investor for more than 22 years, I've seen the stock market go up and down. Without knowledge the stock market can seem like a scary place, but it doesn't have to be this way.

The industry tends to confuse people into thinking that investing is complicated. This way the industry can "take" your money and invest it for you, but remember for this "service" they will take from you thousands of dollars in fees over your lifetime.

Now is the best time to take charge of your investments, save on the fees, and build your own stream of growing passive income each year.

The Financial Freedom Simply Investing Course makes it easy for you to learn how to invest. The Simply Investing Platform implements our strategy and allows you to easily select quality dividend stocks for long-term growth.

To your financial success,![]()

ps: The Simply Investing Course is so easy a 9-year old could do it. In fact my kids took the course when they were nine and today they are still earning dividend income and growing their stock portfolio.

Basic Package

$297

- Simply Investing Course

includes 10 Modules (27 Lessons) - SI Platform-Lite

access to 23 years of stock data - SI Platform-Full

includes 1 month free access - SI Reference Guide

includes How-to Section and Q&A - SI Spreadsheet

evaluate stocks and apply the 12 Rules - SI Stock Portfolio Tracker

track your investments and dividends - Bonus Modules

includes 4 video modules - Money Back Guarantee

30 day money back guarantee - Lifetime Access to Course

includes any future updates

Most Popular

Value Package

$497

- Everything in the Basic Package

includes everything from the Basic Package - SI Platform-Full

includes 2 months free access

SI Criteria applied daily

covers over 6000 stocks (US & CAD)

over 120 metrics for each stock

includes advanced search capabilities

track your portfolio

create your own email alerts

compare stocks side-by-side

10% Discount Code

Discount on future purchases - Lifetime Access to Forum

a place for Q&A

Premium Bundle

$997

Registration is Now Closed

- Everything in the Value Package

includes everything from the Value Package - SI Platform-Full

includes 6 months free access - Live Q&A Group Calls

![]()

Disclaimer: Kanwal Sarai is not an investment advisor, certified financial planner, or broker. Kanwal Sarai is an educator and dividend value investor, and has been for more than two decades. The information provided here is for educational purposes. My opinions are based upon information that I consider reliable, but I do not warrant its completeness or accuracy, and it should not be relied upon as such. The statements and opinions on this newsletter/course/report/video/website/presentation are subject to change without notice. I may personally hold securities mentioned in this course/website/report/video/newsletter. The final decision to buy or sell any stock is yours; please do your own due diligence. Stock buy or sell decisions are based on many factors including your own risk tolerance. When in doubt please consult a professional advisor. No advice on the buying and selling of specific securities is provided. Past performance is not a guarantee of future results. You should not rely on any revenue, sales, or earnings information we present as any kind of promise, guarantee, or expectation of any level of success or earnings. Your results will be determined by a number of factors over which we have no control, such as your financial condition, experiences, skills, level of effort, education, and changes within the market. The names of actual companies or products mentioned herein may be the trademarks of their respective owners. View the complete Terms of Use.