How I saved 4672% in Fees, and Continue to Make Over 14% Each Year on a Single Stock

Update [July 2021]: The TRP dividend today is $2.81,and my dividend yield based on the purchase price is now 21%.

Today I’m going to share with you one of my success stories. The purpose of my story is to show you that great returns are possible without resorting to expensive mutual funds.

My story begins in 2000 when I decided to buy 185 shares in a company called TransCanada (TRP). After applying the 12 Rules of Simply Investing I decided that TRP would be a great investment. TRP had:

- A strong history of profitability

- A strong history of growing dividends

- A product that would be in need for a very long time

- A stock price that made the shares undervalued

I paid $13.40 for each share for a total investment of $2479 ($13.40 x 185 shares). In 2000 TRP was paying a dividend of $0.80 per share, since then the dividend has increased each year, today the dividend is $1.92 per share.

This year my investment in TRP will produce $355.20 in income:

$1.92 x 185 shares = $355.20

$355.20 of $2479 (my original investment) represents a return of 14.33% annually and possibly more if the dividends continue to increase every year. $355.20/$2479 = 14.33%

It’s gets even better; since I’ve owned shares in TRP I’ve received a total of $3481.66 in dividends (cash). Remember I only paid $2479 to buy those shares.

Today TRP shares are trading at $51.54, if I was to sell all my TRP shares the return including dividends would be 525%!

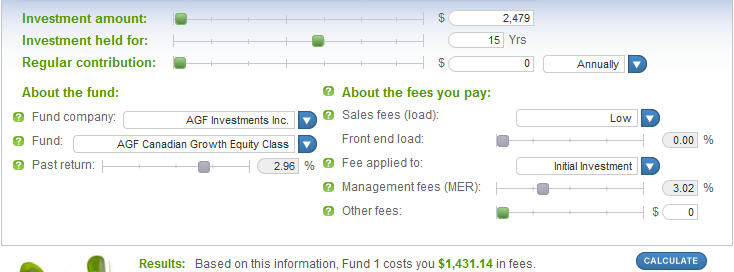

If you are curious about fees, keep reading..... My purchase of TRP shares cost me $29.99 in fees. Had I put the same amount of money in a mutual fund and held the mutual fund for the same amount of time, the total fees would be $1431.14, a 4672% increase!

Would you rather pay $29.99 in fees or $1431.14?

See the screenshot below (BTW I’m not picking on any specific mutual fund, I just picked the first Canadian Equity Fund I could find in the drop-down list.):

Screenshot taken from: GetSmarterAboutMoney.ca

Did you enjoy reading this article? If so, I encourage you to sign up for my newsletter and have these articles delivered via e-mail once a month…and it’s free!

2 comments

Leave a comment